Bank fraud: The interest collected by increasing the loan premium has not been returned yet

Author

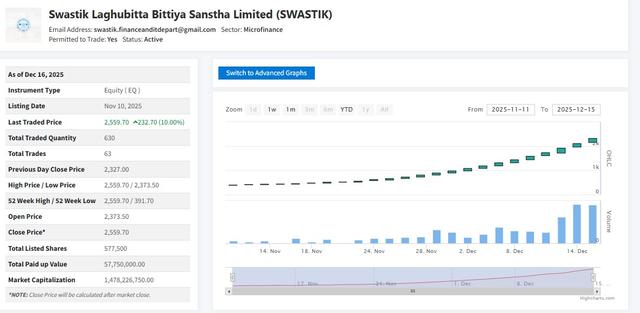

NEPSE trading

Commercial banks have not yet refunded the interest collected by increasing the premium on loans against the directives of the central bank. According to the 61st annual report of the Office of the Auditor General, banks have been changing and increasing the premium rate of interest on loans provided to customers repeatedly.

The Supervision Department of Nepal Rastra Bank had directed the banks on Ashwin 11, 2079, to refund the excess interest collected by increasing the premium. Among the banks in operation, 25 commercial banks were directed to refund a total of 4.66 billion rupees to the respective borrowers.

According to the directive of the central bank, banks have only partially refunded the interest, as mentioned in the auditor general's report. The report states that due to the higher premium rates charged by banks and financial institutions on loans, the prices of goods and services consumed by the general public, the profit of banks and financial institutions, and income tax revenue are also affected.

The auditor general has pointed out that the premium rate taken on loans should be included in the monitoring reports of all banks and financial institutions and necessary actions should be taken.

Overall, the report indicates that banks have not fully complied with the rules and directives of Nepal Rastra Bank, resulting in an additional financial burden on the general public.