Reverse Repo: What It Is, How It Works, and Its Importance

Author

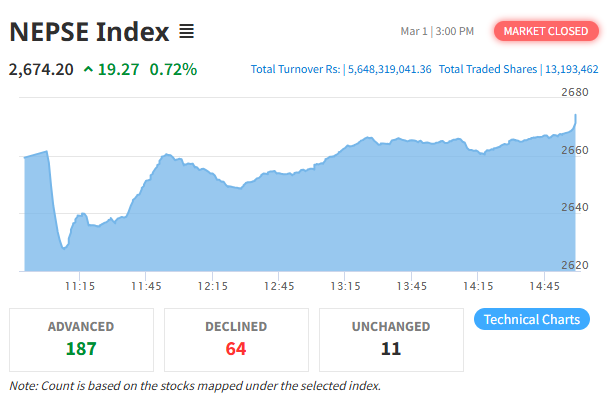

NEPSE trading

Reverse Repo (Reverse Repurchase Agreement) is a monetary tool used by central banks worldwide to manage liquidity in the financial system. The Nepal Rastra Bank, like other central banks, employs reverse repo as a mechanism to withdraw excess liquidity from the banking system to maintain financial stability and balance interest rates.

In this blog, we will explore what a reverse repo is, how it works, its policy implications, its role in Nepal's monetary system, and its significance in the global context.

What is a Reverse Repo?

A Reverse Repo is a process where a central bank borrows funds from commercial banks and financial institutions for a short-term period at a predetermined interest rate. In return, the central bank pledges government securities or other instruments as collateral. After the maturity period, the central bank repays the borrowed funds along with the agreed-upon interest.

Key Objectives of Reverse Repo:

Control Excess Liquidity: When there is excess liquidity in the banking system, it can lead to inflationary pressures and economic instability. Reverse repo helps absorb this surplus.

Regulate Interest Rates: By managing liquidity, reverse repo helps stabilize short-term interest rates.

Promote Economic Stability: It acts as a tool to bring discipline and balance to the financial system.

How Does Reverse Repo Work?

The Process:

Auction/Bidding: The central bank announces a reverse repo auction where eligible banks and financial institutions can participate by quoting interest rates at which they are willing to lend funds.

Specified Tenure: The reverse repo agreement typically spans a short-term period, ranging from 14 days to 6 months. These tenures are categorized as short-term and medium-term.

Interest Rate Determination: The central bank sets a minimum interest rate, and banks bid at or above this rate to participate.

Liquidity Absorption: The central bank accepts bids and collects funds from participating banks, reducing liquidity in the market.

Eligibility:

In Nepal, only "A," "B," and "C" class banks and financial institutions approved by the Nepal Rastra Bank are eligible to participate in reverse repo operations.

Reverse Repo in Nepal

The Nepal Rastra Bank actively uses reverse repo as part of its monetary policy to manage liquidity in the banking system and stabilize the economy.

Contributions to Monetary Policy:

Liquidity Management: Reverse repo helps mop up surplus liquidity in the banking system, preventing inflationary pressures.

Interest Rate Regulation: By reducing excess liquidity, reverse repo aids in stabilizing market interest rates.

Economic Stability: It helps maintain a balance in the financial system and ensures sustainable economic growth.

Example:

In the fiscal year 2080/81 (2023/24), the Nepal Rastra Bank conducted reverse repo operations to absorb approximately NPR 50 billion from the banking system.

Reverse Repo in the Global Context

Reverse repo is widely used by central banks worldwide as an effective monetary policy tool.

United States: The Federal Reserve (Fed) uses reverse repo agreements to manage short-term liquidity and control inflation.

India: The Reserve Bank of India (RBI) employs reverse repo operations to stabilize liquidity and maintain monetary discipline in its banking system.

Comparison: India vs. Nepal

While both countries utilize reverse repo to manage liquidity, India's larger financial market results in broader and more impactful applications compared to Nepal's relatively smaller system.

Benefits of Reverse Repo

Inflation Control: By absorbing excess liquidity, reverse repo helps prevent inflationary pressures in the economy.

Liquidity Management: It allows central banks to regulate the flow of money in the financial system effectively.

Interest Rate Stability: Reverse repo helps stabilize short-term interest rates by managing liquidity levels.

Discipline in Financial Systems: The process ensures that banks and financial institutions manage their liquidity prudently.

Challenges of Reverse Repo

Limited Participation: Financial institutions may be less inclined to participate in reverse repo operations, especially when the offered interest rates are low.

Short-Term Impact: The effects of reverse repo operations are generally limited to the short term and may not address long-term liquidity issues.

Market Instability: Overuse of reverse repo could potentially lead to market instability and liquidity crunches.

Reverse repo is a vital monetary tool that plays a significant role in maintaining stability in the financial system. The Nepal Rastra Bank's effective use of reverse repo operations has contributed to liquidity management, interest rate stability, and economic balance. However, its success depends on careful implementation and addressing the associated challenges.

For developing economies like Nepal, reverse repo operations are crucial in creating a disciplined and resilient financial system. While it addresses immediate liquidity concerns, a long-term strategy is essential to ensure sustainable economic growth.

For more information, visit the official website of the Nepal Rastra Bank (www.nrb.org.np).