Analysis of Non-Banking Assets Held by Commercial Banks

Author

Nepsetrading

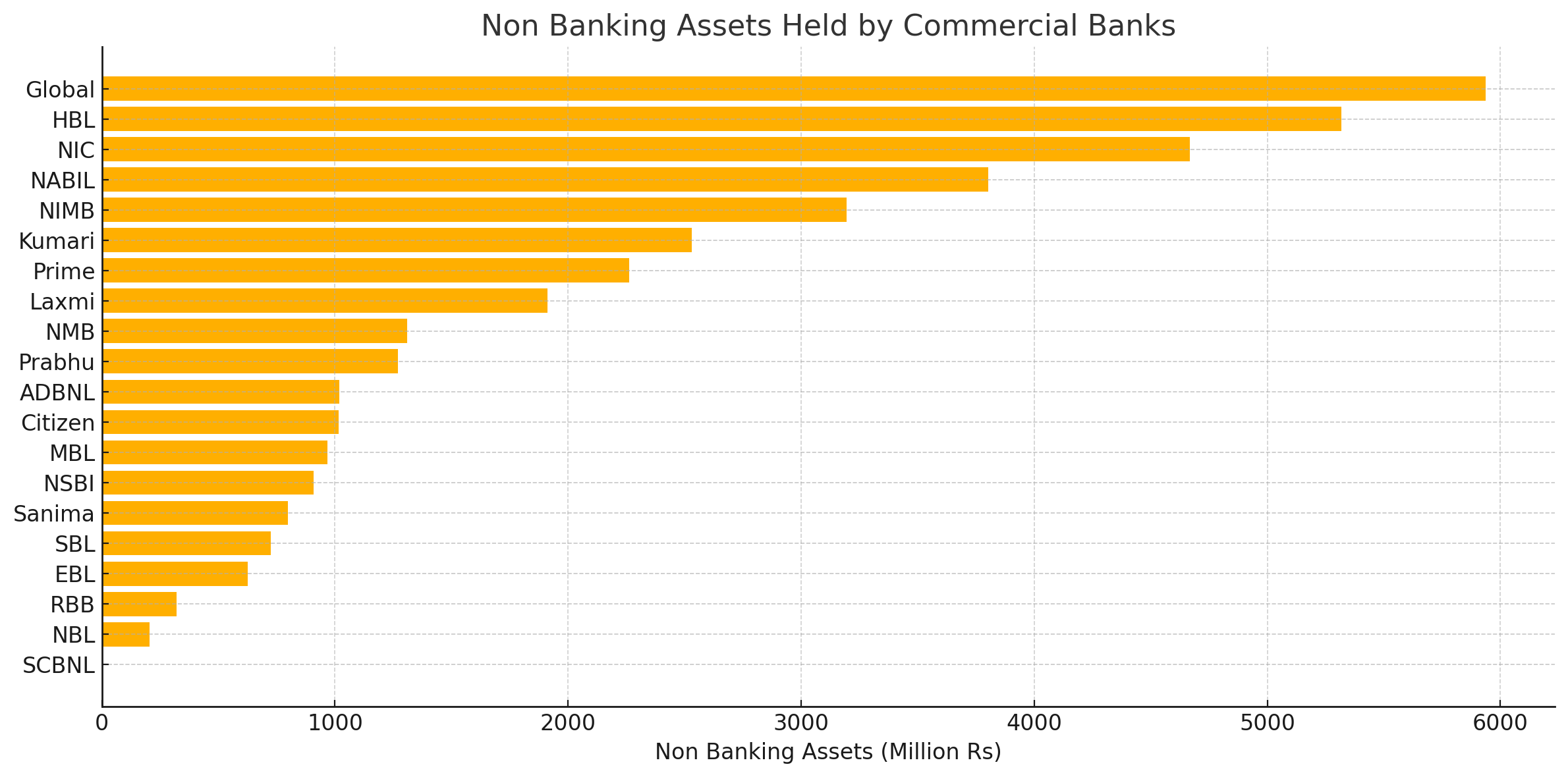

The latest data on non-banking assets (NBA) held by major commercial banks in Nepal highlights a mixed picture in asset quality and recovery practices across the banking sector. Non-banking assets typically represent properties or assets acquired by banks in lieu of defaulted loans—often a key indicator of credit risk management and asset recovery efforts.

Among the banks analyzed, Global IME Bank stands out with the highest volume of non-banking assets, amounting to Rs. 5,936.73 million, closely followed by Himalayan Bank Limited (HBL) at Rs. 5,318.96 million, and NIC Asia Bank at Rs. 4,668.54 million. These figures suggest that these banks have a significant number of default recoveries leading to asset acquisitions or potential write-offs, reflecting aggressive enforcement or default rates in their loan portfolios.

NABIL Bank and NMB Bank also maintain relatively high non-banking assets at Rs. 3,802.66 million and Rs. 3,195.36 million, respectively. While these may indicate effective recovery enforcement, they also raise concerns about underlying credit quality, especially if the trend continues over multiple periods.

Other banks like Kumari Bank (Rs. 2,530.75 million) and Laxmi Sunrise Bank (Rs. 1,912.61 million) report moderate levels of non-banking assets, which may reflect sectoral exposure risks such as real estate or SMEs facing financial stress.

At the lower end, Nepal Bank Limited (NBL) and Rastriya Banijya Bank (RBB) reported the smallest holdings, with Rs. 204.11 million and Rs. 319.95 million, respectively, implying stronger loan book performance or conservative lending and recovery practices. Notably, Standard Chartered Bank Nepal (SCBNL) reported no non-banking assets in this dataset, indicating either an exceptionally strong credit screening or zero default-related asset takeovers during the review period.

Meanwhile, mid-tier banks like Prime Commercial Bank, Citizen Bank, ADBL, and Prabhu Bank report NBA figures between Rs. 1,000 million to Rs. 2,300 million, highlighting the varied recovery practices and asset risks in the banking sector.

In conclusion, the volume of non-banking assets held by commercial banks in Nepal is a critical marker of their credit risk exposure and recovery capabilities. While high NBA may reflect proactive recovery, it can also indicate underlying stress in lending portfolios. Continuous monitoring and effective asset disposal strategies will be essential to prevent these from turning into non-performing burdens on the balance sheets.