NEPSE Index Continues to Decline on Wednesday

Author

NEPSE trading

The Nepal Stock Exchange (NEPSE) index closed lower again on Wednesday, continuing its downward trend for the third consecutive trading day. The NEPSE index fell by 14.88 points, settling at 2,682.15. This decline has further weakened investor sentiment, with the index dropping below the psychological level of 2,700, adding to the uncertainty among investors. As a result, many investors appear to have stopped closely monitoring the market.

Despite the drop in the NEPSE index, trading volume has increased. On Tuesday, the market saw transactions worth NPR 4.34 billion, while on Wednesday, 9.58 million shares of 311 stocks were traded in 54,622 transactions, amounting to NPR 5.14 billion. This rise in trading volume suggests a reduction in panic selling, with investors adopting a "wait-and-watch" approach. Some analysts view this increase in turnover as a positive signal.

Among individual stocks, Mithila Laghubitta Bittiya Sanstha recorded the highest gain of the day, with its share price rising by 9.39%. The stock climbed NPR 170 to close at NPR 1,980 per share, following a 9.96% increase on Tuesday, indicating growing investor interest. Similarly, Garima Samriddhi Yojana’s unit price rose by over 7.5%, Bhugol Energy Development Company’s share price increased by 7.5%, and Green Development Bank’s share price gained 7%. These gains have injected some optimism into the market. Conversely, Samudayik Laghubitta Bittiya Sanstha saw the steepest decline, with its share price dropping 9.20%. This follows an 8.21% fall on Tuesday, signaling a loss of investor confidence in the stock.

In terms of trading volume, Himalayan Reinsurance topped the list with NPR 296.7 million worth of shares traded, maintaining its leading position from Tuesday (NPR 321.1 million). Other notable performers included NRN Infrastructure and Development (NPR 235 million) and Nepal Reinsurance Company (over NPR 170 million), reflecting sustained investor interest in these companies.

Of the 13 sub-indices, three showed marginal gains, while 10 declined. The hotel and tourism, mutual fund, and trading sub-indices posted slight increases, contributing some positive momentum. However, the finance sub-index fell the most, down 1.53%, followed by the life insurance sub-index, which dropped by over 1%. These declines have added to the broader negative pressure on the market.

Analysts note that investor morale is at a low ebb, despite strong fundamentals such as bank interest rates, ample liquidity, and robust domestic and external economic indicators. The psychological pressure persists, with the NEPSE index at 2,682.15 fueling further uncertainty. Some analysts argue that the market is not in a "bearish" trend but rather a "sideways" one, pointing to reduced panic selling and opportunities for buying. The increase in trading volume and the absence of widespread panic selling support this view.

The market’s downward trajectory, initially triggered by profit booking, has been exacerbated by recent political instability. Speculation around changes in the ruling coalition has reportedly created short-term disruptions, further eroding investor confidence and contributing to market volatility. Nevertheless, analysts reassure investors that the stock market will not decline indefinitely and is likely to rebound. They suggest that the current dip has made share prices attractive, particularly for fundamentally strong companies, and that planned investments in dividend-paying stocks could yield good returns in the future.

Despite the ongoing decline, some analysts maintain that the market remains in a "bull run." They highlight that cheaper share prices and opportunities in dividend-capable companies make this a favorable time for investment. However, they advise caution and recommend a "wait-and-watch" strategy until the market’s direction becomes clearer.

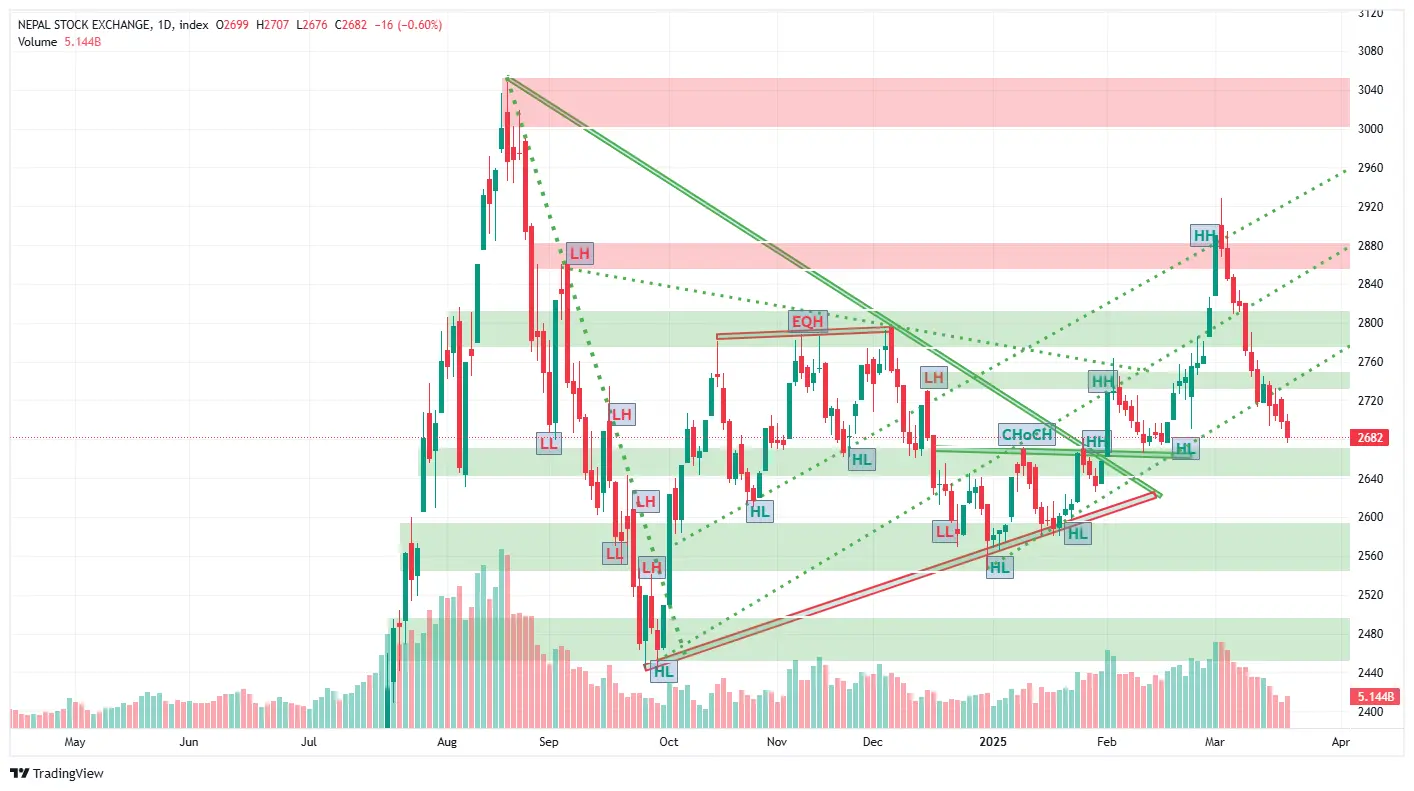

Technical Analysis

From a technical perspective, experts suggest that the market remains in a support zone as long as it does not fall below 2,660. They argue that the market is not in an extremely negative state. However, with the index slipping below 2,700, there is growing concern about a potential negative shift. The absence of panic selling and the fact that operators have not offloaded stocks are cited as reasons for cautious optimism.

Broker Analysis

Among brokers, Broker No. 58 led the market on Wednesday with a turnover of NPR 639.2 million, accounting for 6.214% of the total market volume. This broker recorded NPR 338 million in purchases and NPR 301.1 million in sales, with a buy-sell ratio of 1.123. Broker No. 49 ranked second with NPR 423.5 million in transactions (4.12% of the market), though its buy-sell ratio of 0.918 indicates higher selling pressure. Broker No. 42 came in third with NPR 410.2 million (3.988% of the market).

Broker No. 28 achieved the highest buy-sell ratio of 1.383, with NPR 147.1 million in purchases and NPR 106.7 million in sales. Meanwhile, Broker No. 49 recorded a net holding loss of NPR 18.1 million, suggesting persistent selling pressure in the market. These figures indicate a mixed dynamic, with some brokers showing confidence while others reflect caution.