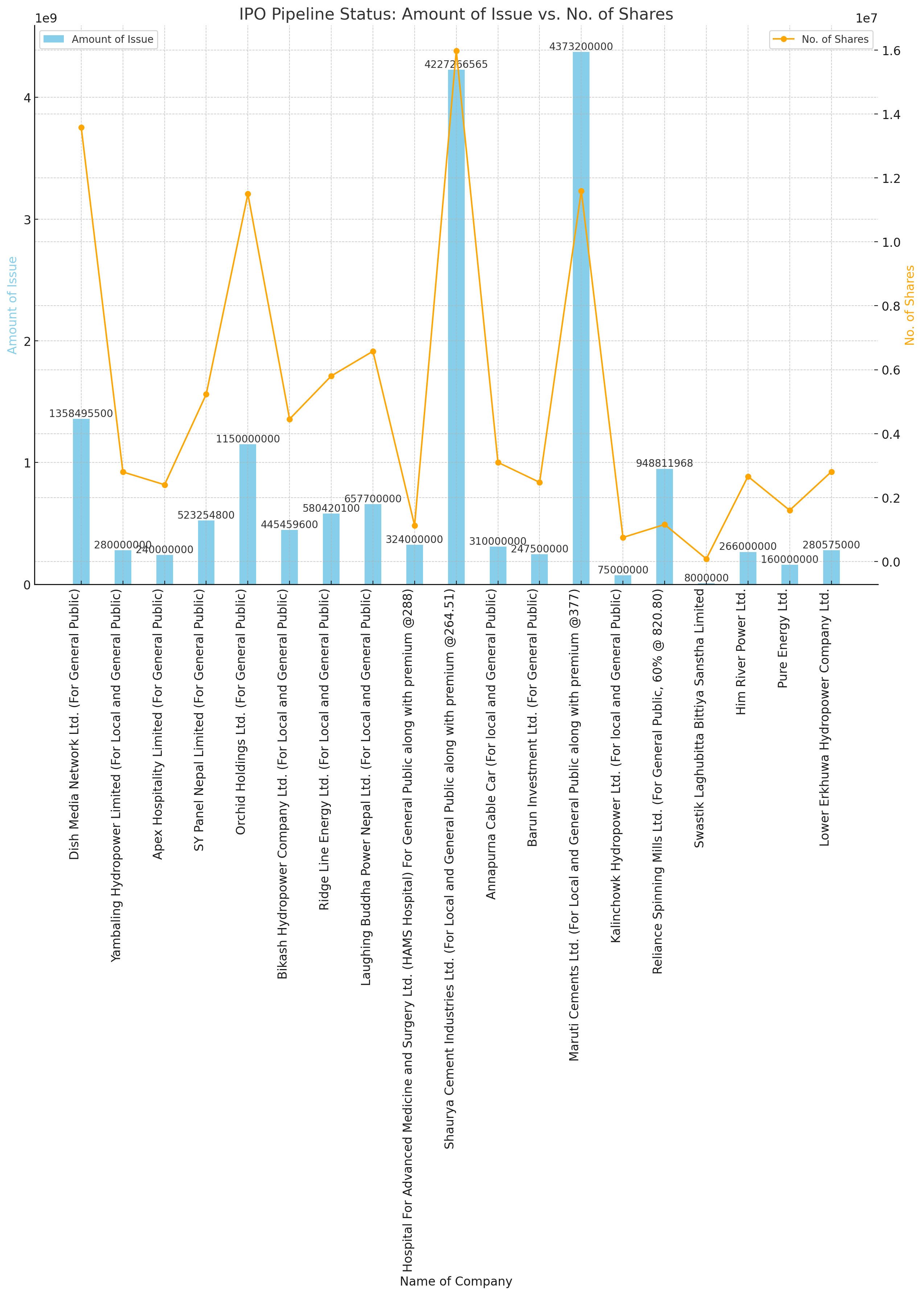

There are 19 companies in the IPO pipeline

Author

NEPSE trading

The Securities Board of Nepal has released a detailed update on the Initial Public Offerings (IPOs) slated for the fiscal year 2080/81. The report highlights a diverse array of companies across various sectors, reflecting a robust interest in market participation and investment.

Key Highlights:

1. Dish Media Network Ltd. tops the list with an IPO issuance of 13,584,955 shares, amounting to NPR 1.36 billion. This substantial offering underscores the growing prominence of the media sector in attracting investor interest.

2. Hydropower Sector Dominance: Multiple hydropower companies, including Yambaling Hydropower Limited, Bikash Hydropower Company Ltd., Ridge Line Energy Ltd., and others, continue to flood the market. Their collective issuance highlights the critical role of renewable energy in Nepal's economic development. Notably, Solu Hydropower Limited has one of the largest issuances in this sector with 20 million shares worth NPR 2 billion.

3. Shaurya Cement Industries Ltd. stands out with a massive IPO of 15,981,500 shares valued at over NPR 4.22 billion, reflecting the high capital needs and potential growth within the manufacturing sector.

4. Healthcare Sector Entry: The IPO of Hospital for Advanced Medicine and Surgery Ltd. (HAMS Hospital) with a premium pricing strategy marks a significant entry into the market, signifying investor confidence in the healthcare industry's future prospects.

5. **Tourism and Hospitality:** Orchid Holdings Ltd. and Hotel Forest Inn Ltd. are among the notable entries in the tourism sector, with significant IPOs aimed at leveraging Nepal's growing tourism industry.

Interpretation:

The data reveals a strong inclination towards the hydropower and manufacturing sectors, which are vital for the nation's infrastructure and economic growth. The high number of shares issued by hydropower companies indicates a strategic push towards renewable energy, essential for sustainable development. Additionally, the manufacturing sector's significant IPO volumes suggest ongoing industrial expansion and modernization.

The healthcare sector's presence in the IPO pipeline, highlighted by HAMS Hospital, is a positive indicator of the sector's potential and the increasing demand for advanced medical facilities in Nepal.

Overall, the diverse range of sectors represented in the IPO pipeline reflects a balanced and multifaceted approach to economic growth. Investors have a broad spectrum of opportunities, from traditional manufacturing and hydropower to emerging sectors like healthcare and tourism. This trend is likely to foster a more resilient and diversified economic landscape in Nepal.

Key Highlights:

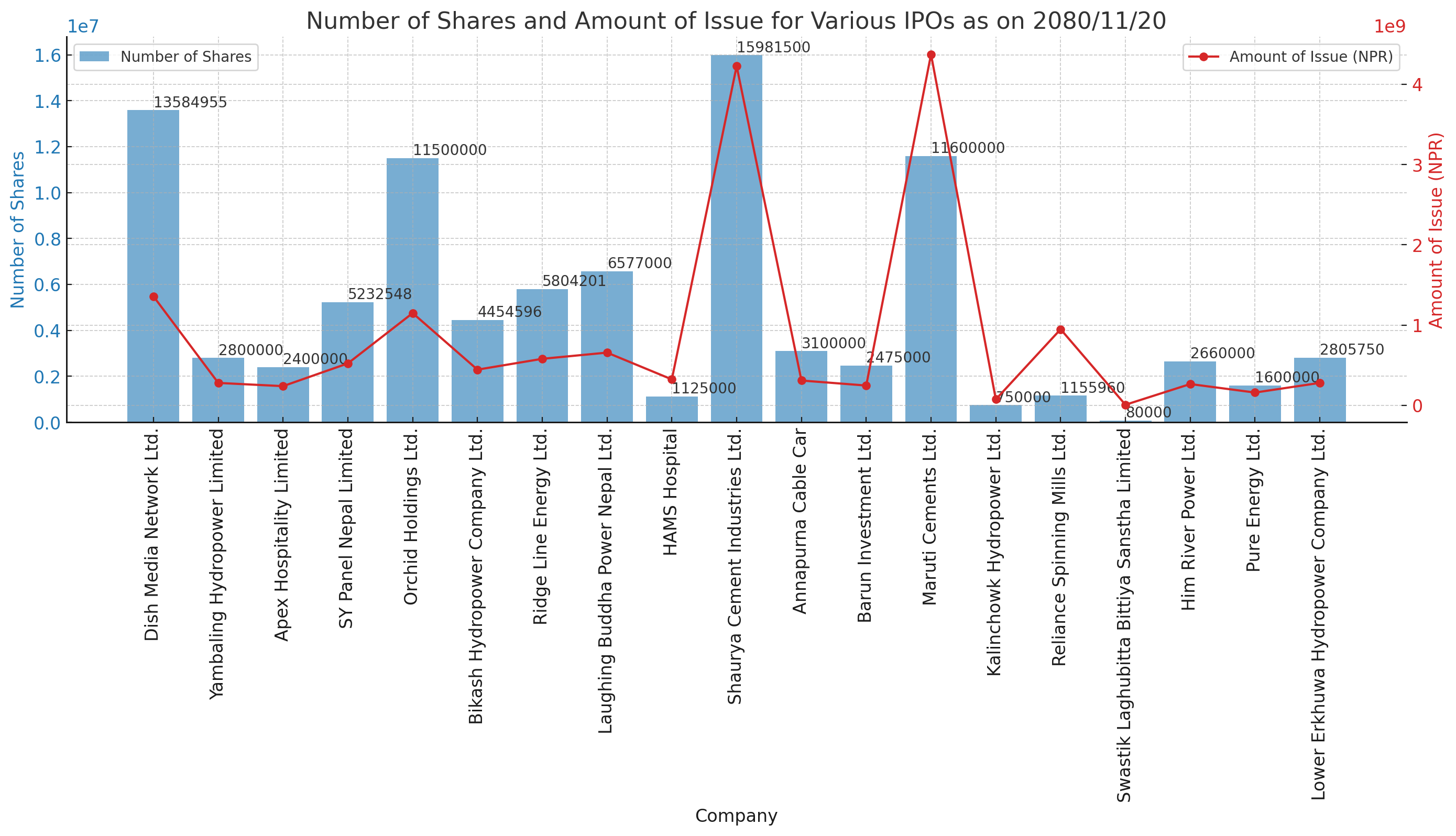

Dish Media Network Ltd. (Others)

Shares Issued: 13,584,955

Amount: NPR 1,358,495,500

Issue Manager: Prabhu Capital Ltd.

Date of Application: 2080/03/12

Yambaling Hydropower Limited (Hydro)

Shares Issued: 2,800,000

Amount: NPR 280,000,000

Issue Manager: Muktinath Capital Limited

Date of Application: 2080/06/10

Apex Hospitality Limited (Other)

Shares Issued: 2,400,000

Amount: NPR 240,000,000

Issue Manager: Himalayan Capital Limited

Date of Application: 2080/06/12

SY Panel Nepal Limited (Manufacturing and Processing)

Shares Issued: 5,232,548

Amount: NPR 523,254,800

Issue Manager: Prabhu Capital Limited

Date of Application: 2080/06/19

Orchid Holdings Ltd. (Hotels and Tourism)

Shares Issued: 11,500,000

Amount: NPR 1,150,000,000

Issue Manager: Laxmi Capital Market Ltd.

Date of Application: 2080/08/13

Bikash Hydropower Company Ltd. (Hydro)

Shares Issued: 4,454,596

Amount: NPR 445,459,600

Issue Manager: Prabhu Capital Ltd.

Date of Application: 2080/08/19

Ridge Line Energy Ltd. (Hydro)

Shares Issued: 5,804,201

Amount: NPR 580,420,100

Issue Manager: Prabhu Capital Ltd.

Date of Application: 2080/08/25

Laughing Buddha Power Nepal Ltd. (Hydro)

Shares Issued: 6,577,000

Amount: NPR 657,700,000

Issue Manager: Nabil Investment Banking Ltd.

Date of Application: 2080/09/02

Hospital For Advanced Medicine and Surgery Ltd. (HAMS Hospital) (Other)

Shares Issued: 1,125,000

Amount: NPR 324,000,000

Issue Manager: Muktinath Capital Limited

Date of Application: 2080/09/06

Shaurya Cement Industries Ltd. (Manufacturing and Processing)

Shares Issued: 15,981,500

Amount: NPR 4,227,266,565

Issue Manager: Nabil Investment Banking Ltd.

Date of Application: 2080/09/12

Annapurna Cable Car (Other)

Shares Issued: 3,100,000

Amount: NPR 310,000,000

Issue Manager: Muktinath Capital Limited

Date of Application: 2080/09/16

Barun Investment Ltd. (Investment)

Shares Issued: 2,475,000

Amount: NPR 247,500,000

Issue Manager: Global IME Capital Ltd.

Date of Application: 2080/09/25

Maruti Cements Ltd. (Manufacturing and Processing)

Shares Issued: 11,600,000

Amount: NPR 4,373,200,000

Issue Manager: Nabil Investment Banking Ltd.

Date of Application: 2080/09/26

Kalinchowk Hydropower Ltd. (Hydro)

Shares Issued: 750,000

Amount: NPR 75,000,000

Issue Manager: RBB Merchant Banking Ltd.

Date of Application: 2080/10/22

Reliance Spinning Mills Ltd. (Manufacturing and Processing)

Shares Issued: 1,155,960

Amount: NPR 948,811,968

Issue Manager: Global IME Capital Ltd.

Date of Application: 2080/10/23

Swastik Laghubitta Bittiya Sanstha Limited (Microfinance)

Shares Issued: 80,000

Amount: NPR 8,000,000

Issue Manager: Nabil Investment Banking Ltd.

Date of Application: 2080/10/24

Him River Power Ltd. (Hydro)

Shares Issued: 2,660,000

Amount: NPR 266,000,000

Issue Manager: Siddhartha Capital Ltd.

Date of Application: 2080/10/28

Pure Energy Ltd. (Others)

Shares Issued: 1,600,000

Amount: NPR 160,000,000

Issue Manager: Nabil Investment Banking Ltd.

Date of Application: 2080/10/29

Lower Erkhuwa Hydropower Company Ltd. (Hydro)

Shares Issued: 2,805,750

Amount: NPR 280,575,000

Issue Manager: Muktinath Capital Limited

Date of Application: 2080/11/11

Total:

Number of Shares: 95,686,510

Amount of Issue: NPR 16,455,683,533

Interpretation:

The detailed IPO data for 2080/81 reveals a strong preference for investments in the hydropower sector, accounting for a significant portion of the total shares and capital raised. This trend underscores Nepal's strategic focus on renewable energy and sustainable development.

Manufacturing also plays a crucial role, with substantial IPOs from companies like Shaurya Cement Industries Ltd. and Maruti Cements Ltd., indicating ongoing industrial growth and modernization efforts.

The healthcare sector, represented by HAMS Hospital, signals increasing investor confidence in advanced medical facilities, a vital component for improving national healthcare standards.

Tourism and hospitality sectors, highlighted by Orchid Holdings Ltd. and Hotel Forest Inn Ltd., aim to leverage Nepal's booming tourism industry, promising substantial returns and sectoral growth.

In summary, the IPO pipeline reflects a diversified and balanced approach towards economic development, offering a broad spectrum of investment opportunities. The Securities Board of Nepal's proactive efforts in managing these IPOs ensure a stable and vibrant market, fostering investor confidence and contributing to Nepal's economic resilience.

Conclusion:

The IPO pipeline for the fiscal year 2080/81 showcases a vibrant and dynamic market, with substantial participation across multiple sectors. This diversity not only provides investors with varied opportunities but also strengthens the foundation for Nepal's sustained economic development. The Securities Board of Nepal's proactive approach in managing and facilitating these IPOs is commendable and essential for maintaining investor confidence and market stability.