By Writer Content

HBL's Fluctuating EPS and Rising NPLs Highlight Mixed Performance

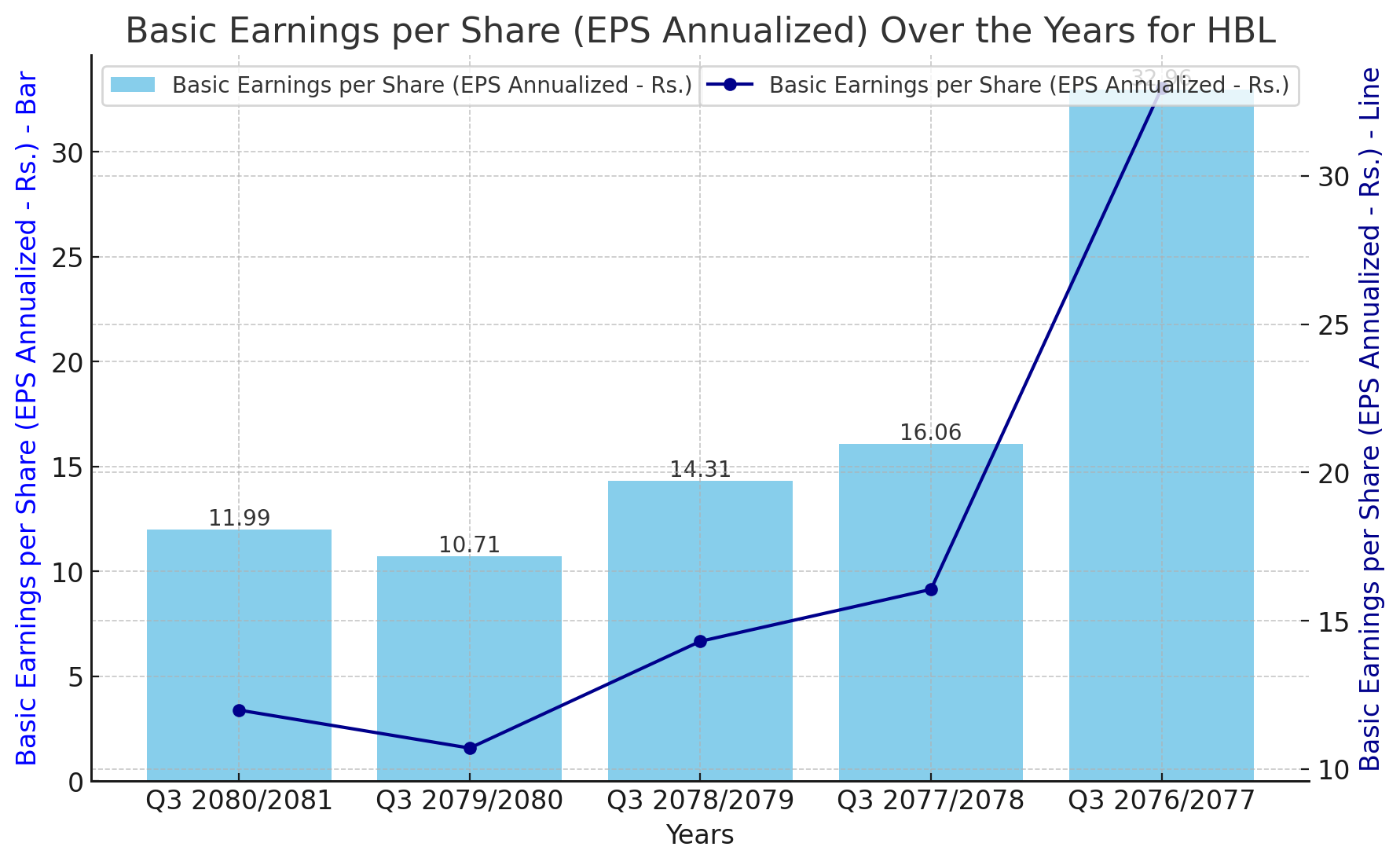

HBL's Basic Earnings per Share Demonstrates Significant Fluctuations

HBL, a prominent banking sector entity, has exhibited considerable variability in its Basic Earnings per Share (EPS) over the past five years. The latest financial data reveals noteworthy fluctuations, indicating shifts in profitability and operational efficiency.

Key Highlights:

Q3 2080/2081: EPS was 11.99, showing an increase from the previous year.

Q3 2079/2080: EPS stood at 10.71, reflecting a decrease from the prior year.

Q3 2078/2079: EPS rose to 14.31, demonstrating improved financial performance.

Q3 2077/2078: EPS reached 16.06, marking a peak performance year.

Q3 2076/2077: EPS was significantly higher at 32.96, indicating the highest profitability in the five-year period.

Interpretation:

The data reveals significant fluctuations in HBL's Basic Earnings per Share, highlighting varying levels of profitability and operational performance. The peak EPS of 32.96 in Q3 2076/2077 suggests an exceptional year for HBL, likely driven by robust revenue growth and efficient cost management. This peak indicates the bank's highest profitability and operational success during the observed period.

However, the decline to 10.71 in Q3 2079/2080 reflects challenges that may have impacted the bank's profitability, such as increased costs, reduced revenues, or other financial difficulties. The subsequent recovery to 11.99 in Q3 2080/2081 demonstrates the bank's efforts to stabilize and enhance its financial performance.

Future Outlook:

To sustain and improve its EPS, HBL must focus on strategies that drive consistent revenue growth and operational efficiency. This includes optimizing operational processes, expanding profitable services, and maintaining stringent cost controls. Effective risk management will also be crucial to mitigate potential downsides and ensure stable returns.

Investors should closely monitor HBL's quarterly performance to understand the bank's ongoing profitability and strategic direction. A steady increase in EPS is a positive indicator of the bank's financial health and its ability to generate shareholder value.

In conclusion, while HBL's Basic Earnings per Share has shown significant fluctuations over the past five years, the bank's efforts to stabilize and improve its profitability are evident. Continued focus on operational efficiency and revenue growth will be key to achieving sustained financial performance and shareholder returns in the future.

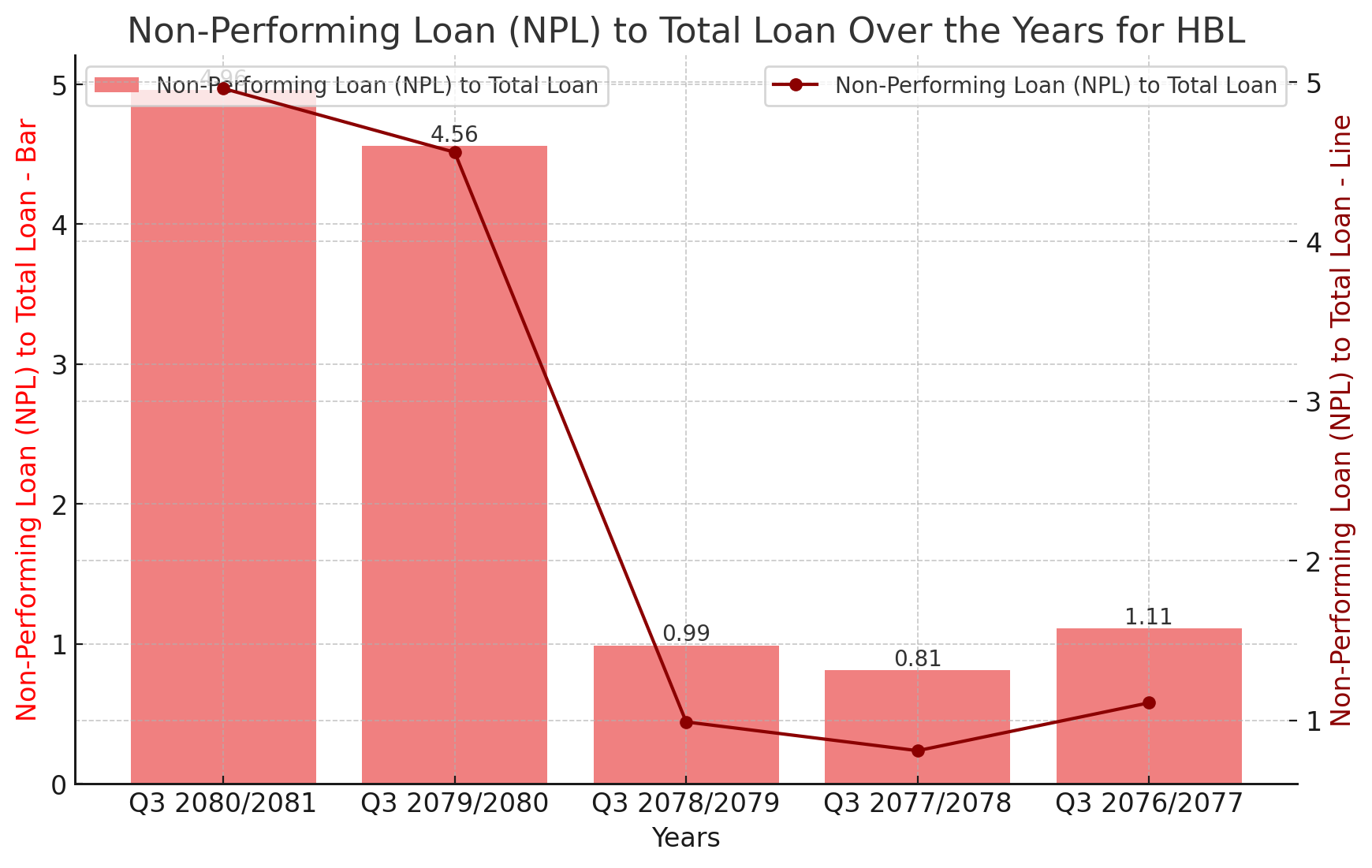

HBL's Rising Non-Performing Loans Raise Concerns

HBL, a key player in the banking sector, has experienced a significant increase in its Non-Performing Loan (NPL) ratio over the past five years. The latest financial data shows a worrying trend, indicating rising credit risk and potential challenges in loan recovery.

Key Highlights:

Q3 2080/2081: NPL to Total Loan ratio surged to 4.96%, the highest in the five-year period.

Q3 2079/2080: The ratio was 4.56%, reflecting a substantial increase from previous years.

Q3 2078/2079: The ratio dropped to 0.99%, showing better loan performance.

Q3 2077/2078: The ratio further decreased to 0.81%, indicating strong asset quality.

Q3 2076/2077: The ratio was 1.11%, relatively stable compared to other years.

Interpretation:

The rising trend in HBL's NPL ratios signals increasing credit risk for the bank. The significant jump to 4.96% in Q3 2080/2081 suggests that a larger portion of the bank's loans are not performing as expected, leading to potential financial instability. This increase could be attributed to various factors such as economic downturns, poor lending practices, or challenges in loan recovery processes.

The steady decline in NPL ratios from Q3 2076/2077 to Q3 2077/2078, and then to Q3 2078/2079, reflects a period of strong asset quality and effective credit management. However, the subsequent rise in the following years raises concerns about the bank's loan portfolio quality and its ability to manage credit risk effectively.

Future Outlook:

HBL must implement stringent measures to control the rising NPL ratios. This includes strengthening credit appraisal processes, enhancing loan recovery efforts, and possibly restructuring problematic loans. Effective risk management practices will be crucial to prevent further deterioration in asset quality.

Investors and stakeholders should closely monitor HBL's quarterly performance and management strategies to address the increasing NPL ratios. The bank's ability to mitigate these risks will be critical in ensuring its financial stability and profitability in the long run.

In conclusion, the rising NPL to Total Loan ratio over the past five years is a cause for concern for HBL. The bank must take immediate and effective measures to control this trend and restore confidence among its investors and customers.

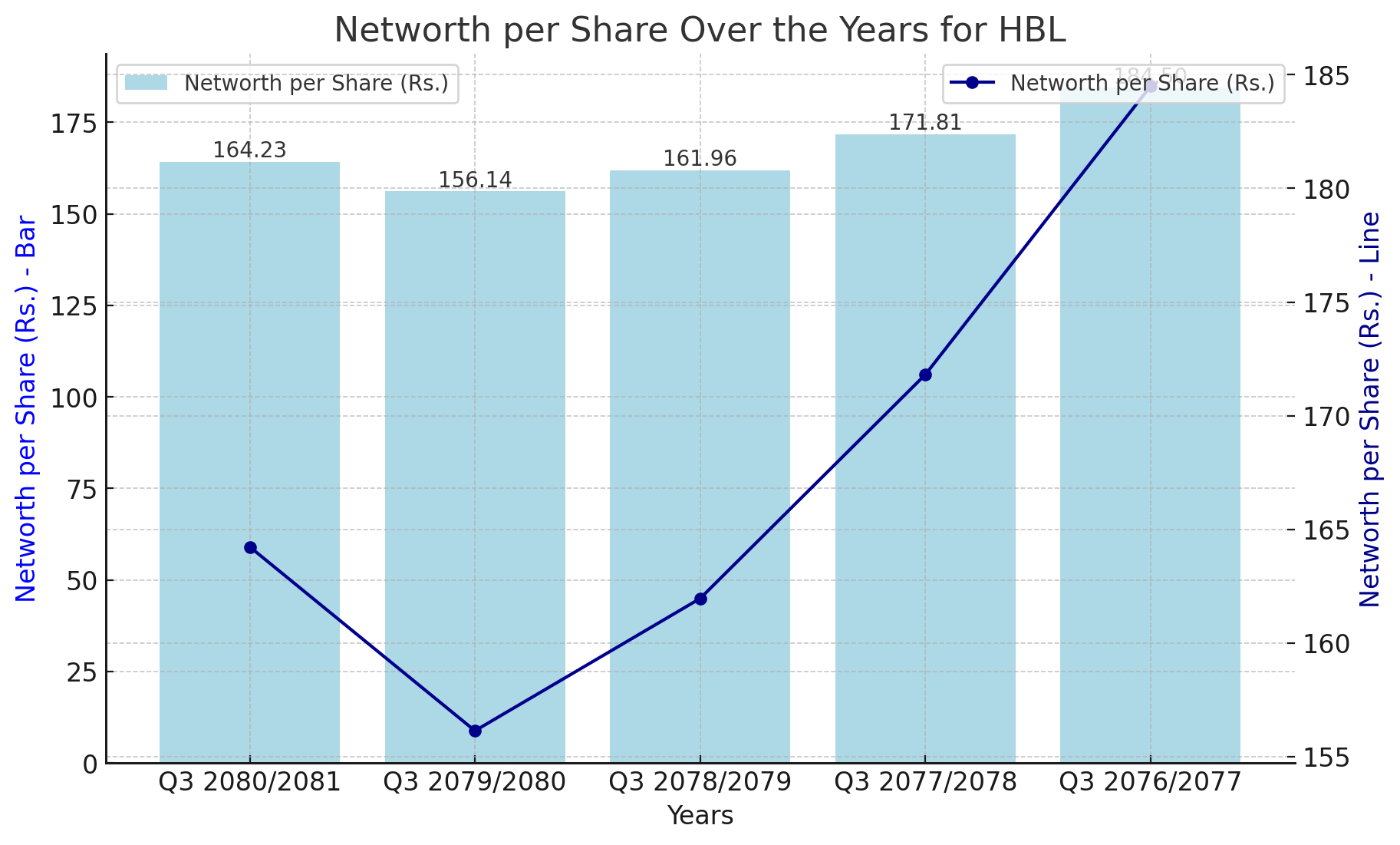

HBL's Networth per Share Reflects Consistent Growth with Minor Fluctuations

HBL, a major entity in the banking sector, has shown steady growth in its Networth per Share (NPS) over the past five years. The latest financial data highlights an upward trend with some fluctuations, underscoring the bank's overall financial health and stability.

Key Highlights:

Q3 2080/2081: NPS reached 164.23, indicating an increase from the previous year.

Q3 2079/2080: NPS was 156.14, reflecting a slight decrease from the prior year.

Q3 2078/2079: NPS stood at 161.96, showing a recovery and improvement.

Q3 2077/2078: NPS was 171.81, marking a high point in the observed period.

Q3 2076/2077: NPS was 184.5, the highest in the five-year span.

Interpretation:

The data reveals a generally positive trend in HBL's Networth per Share, indicating the bank's robust financial performance and asset growth. The peak of 184.5 in Q3 2076/2077 represents the highest net worth per share, suggesting a period of strong capital accumulation and efficient asset management.

The subsequent decrease to 156.14 in Q3 2079/2080 points to minor operational challenges or market conditions that temporarily impacted the bank's net worth. However, the recovery to 164.23 in Q3 2080/2081 demonstrates HBL's ability to regain its financial strength and improve its asset base.

Future Outlook:

HBL's consistent growth in Networth per Share is a positive indicator for investors and stakeholders. The bank's ability to sustain this growth will depend on its continued focus on sound financial practices, strategic investments, and effective risk management.

Investors should consider the bank's solid performance and growth trajectory when making investment decisions. The increasing NPS also reflects HBL's potential for future profitability and value creation for shareholders.

In conclusion, HBL's Networth per Share has shown steady growth with minor fluctuations over the past five years. The bank's strong financial foundation and effective management strategies position it well for continued success and stability in the future.

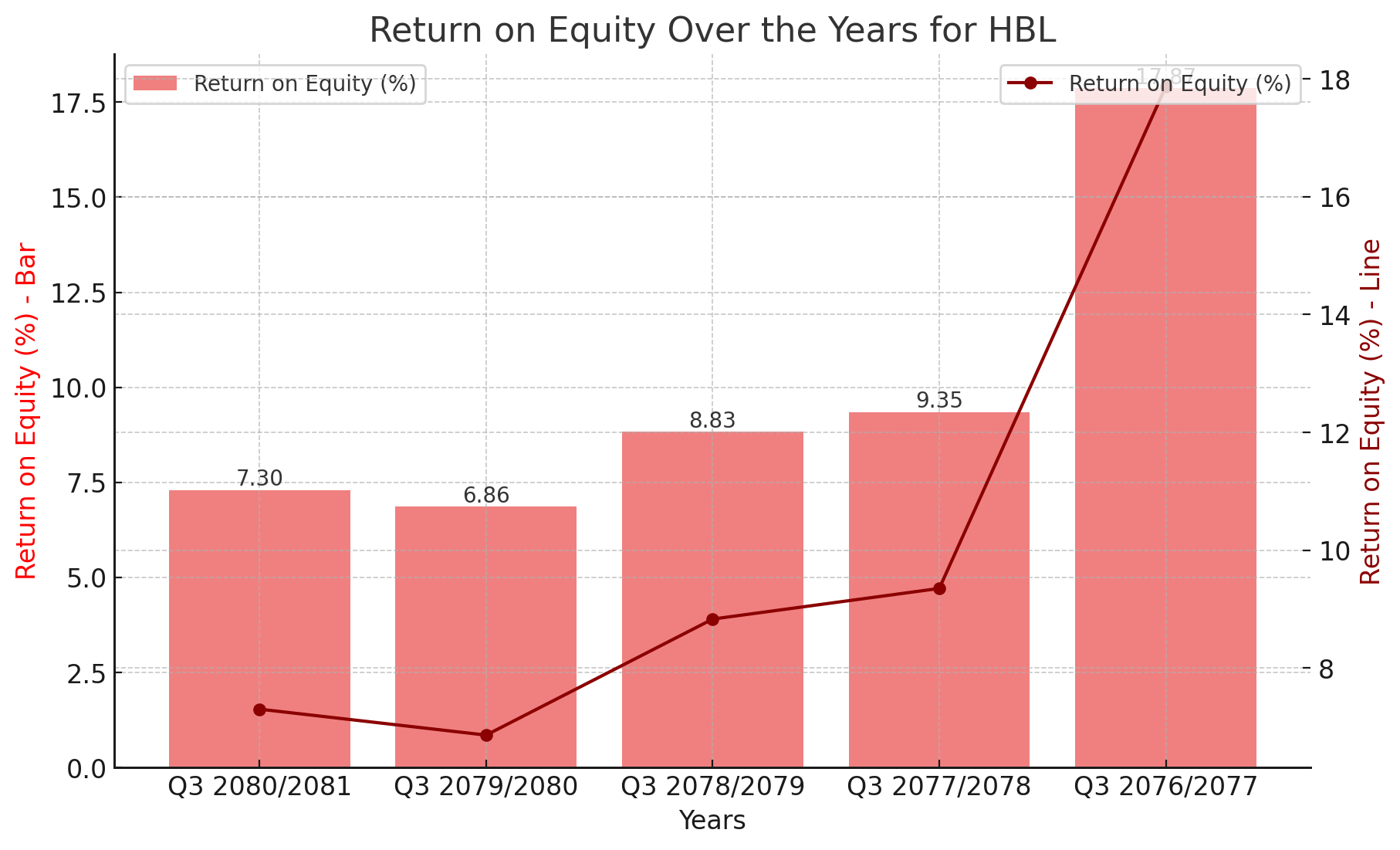

HBL's Return on Equity Shows Declining Trend with Recent Stabilization

HBL, a prominent player in the banking sector, has experienced fluctuations in its Return on Equity (ROE) over the past five years. The latest financial data reveals a declining trend with recent signs of stabilization, indicating changes in the bank's profitability and efficiency in generating returns on its equity.

Key Highlights:

Q3 2080/2081: ROE was 7.3%, showing a slight increase from the previous year.

Q3 2079/2080: ROE stood at 6.86%, reflecting a decrease from the prior year.

Q3 2078/2079: ROE was 8.83%, indicating better financial performance.

Q3 2077/2078: ROE reached 9.35%, marking a stable performance year.

Q3 2076/2077: ROE peaked at 17.87%, showcasing the highest point in the five-year period.

Interpretation:

The data indicates a declining trend in HBL's Return on Equity over the observed period, highlighting challenges in maintaining profitability and efficiency. The peak ROE of 17.87% in Q3 2076/2077 suggests an exceptional year for the bank, likely driven by high net income relative to shareholders' equity. This period represents the bank's highest efficiency in generating returns for its shareholders.

However, the subsequent decline to 6.86% in Q3 2079/2080 reflects challenges such as increased expenses, lower income, or other financial difficulties that may have impacted the bank's profitability. The recent stabilization to 7.3% in Q3 2080/2081 demonstrates the bank's efforts to stabilize and improve its financial performance.

Future Outlook:

To sustain and enhance its ROE, HBL must focus on strategies that boost profitability and optimize the use of equity. This includes improving operational efficiency, enhancing revenue streams, and maintaining stringent cost controls. Effective risk management will also be crucial to mitigate potential downsides and ensure stable returns.

Investors should monitor HBL's quarterly performance to understand the bank's ongoing profitability and strategic direction. A consistently high ROE is a positive indicator of the bank's ability to generate value for shareholders.

In conclusion, while HBL's Return on Equity has shown a declining trend over the past five years, the bank's efforts to stabilize and improve its profitability are evident. Continued focus on operational efficiency and revenue growth will be key to achieving sustained financial performance and shareholder returns in the future.

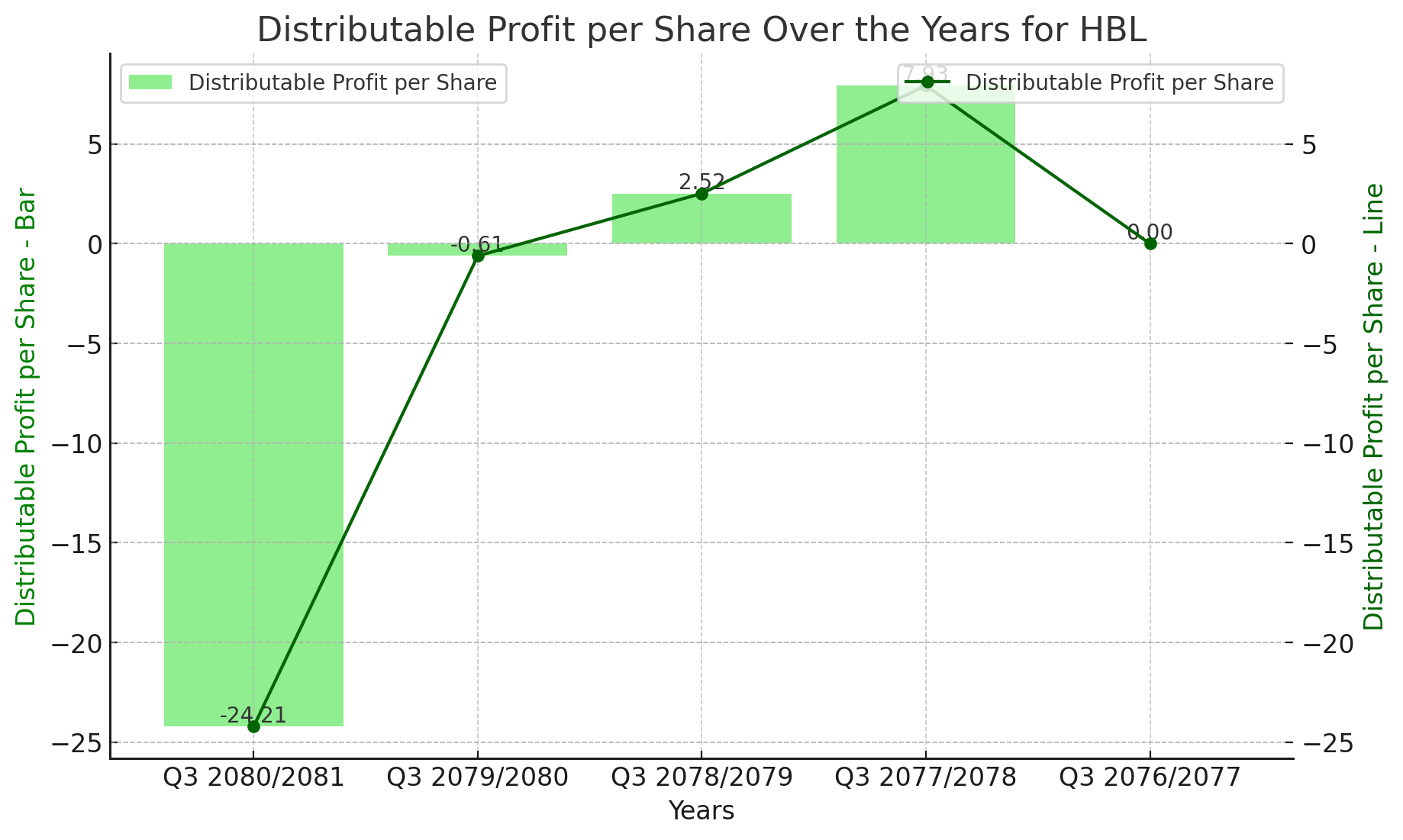

HBL's Distributable Profit per Share Reveals Significant Volatility

Kathmandu, June 21, 2024 - HBL, a prominent entity in the banking sector, has exhibited substantial fluctuations in its Distributable Profit per Share over the past five years. The latest financial data indicates dramatic shifts, reflecting the bank's varying profitability and distribution capabilities.

Key Highlights:

Q3 2080/2081: Distributable Profit per Share dropped significantly to -24.21, indicating a substantial loss.

Q3 2079/2080: The value was -0.61, showing a minimal loss compared to the previous year.

Q3 2078/2079: Distributable Profit per Share increased to 2.52, demonstrating a positive turnaround.

Q3 2077/2078: The value reached 7.93, marking a peak in profitability for distribution.

Q3 2076/2077: The value was zero, indicating no distributable profit for that year.

Interpretation:

The significant volatility in HBL's Distributable Profit per Share highlights varying levels of profitability and operational performance. The peak value of 7.93 in Q3 2077/2078 suggests a year of strong profitability and efficient operations, enabling the bank to distribute substantial profits per share.

The dramatic decline to -24.21 in Q3 2080/2081 indicates severe financial challenges, potentially due to increased expenses, reduced revenues, or other operational difficulties. This substantial loss suggests that the bank faced significant financial headwinds, affecting its ability to generate distributable profits.

Future Outlook:

To stabilize and enhance its Distributable Profit per Share, HBL must focus on strategies that drive consistent revenue growth and cost efficiency. This includes optimizing operational processes, expanding profitable services, and maintaining stringent cost controls. Effective risk management will also be crucial to mitigate potential downsides and ensure stable distributable profits.

Investors and stakeholders should monitor HBL's quarterly performance to understand the bank's ongoing profitability and strategic direction. A steady increase in distributable profit per share is a positive indicator of the bank's financial health and its ability to provide returns to shareholders.

In conclusion, while HBL's Distributable Profit per Share has shown significant volatility over the past five years, the bank's efforts to stabilize and improve its profitability are evident. Continued focus on operational efficiency and revenue growth will be key to achieving sustained financial performance and shareholder returns in the future.