By Sandeep Chaudhary

Nepal Commercial Bank Fixed Deposit Interest Rates: A Three-Month Comparative Analysis

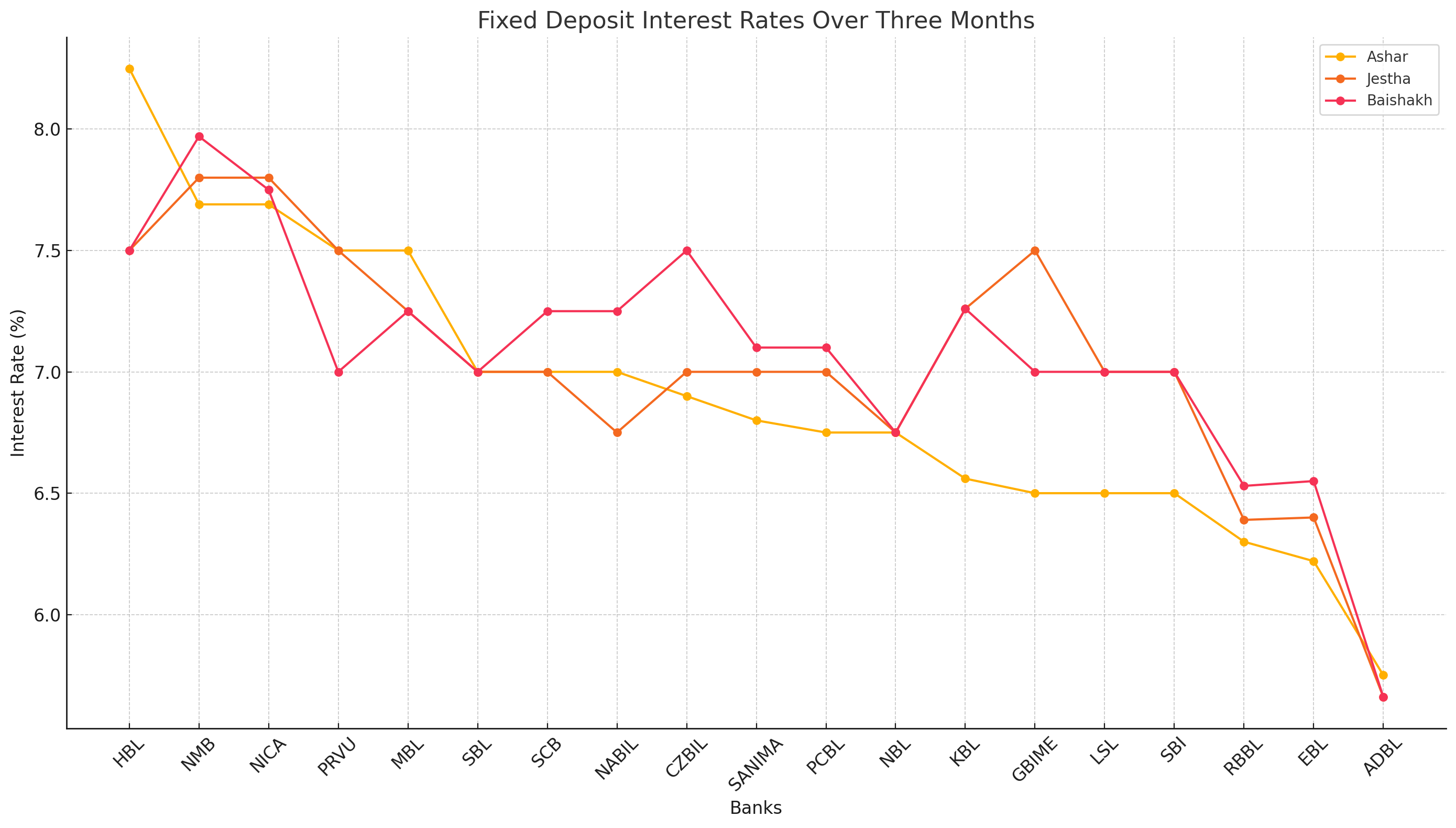

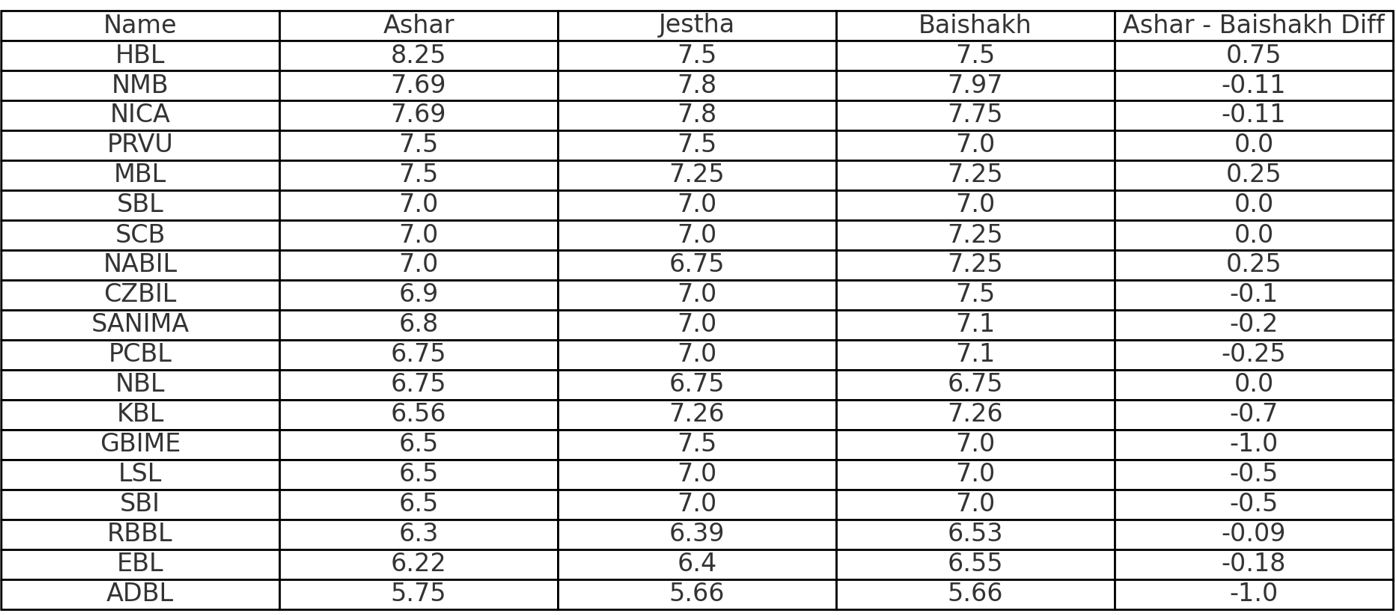

In the ever-evolving financial landscape, the interest rates on fixed deposits offered by various banks in Nepal have shown noticeable changes over the past three months. This report delves into the interest rates for Ashar, Jestha, and Baishakh, providing insights and interpretations based on the observed trends

Key Observations

Consistent Rates:

Banks such as Siddhartha Bank Limited (SBL), Standard Chartered Bank (SCB), and Nepal Bangladesh Bank (NBL) maintained consistent interest rates over the three months, indicating stability and a conservative approach to interest rate adjustments.

Significant Decreases:

Global IME Bank Limited (GBIME) and Kist Bank Limited (KBL) experienced notable decreases of -1.00% and -0.70%, respectively. These significant drops suggest possible shifts in their financial policies or a response to changes in the broader economic environment.

Incremental Adjustments:

Banks like NABIL Bank Limited (NABIL) and Citizens Bank International Limited (CZBIL) made slight positive adjustments to their interest rates, possibly to remain competitive and attract more fixed deposit customers.

Interpretation and Market Sentiment

The average change across all listed banks was -0.14%, suggesting a slight downward trend in fixed deposit interest rates overall. This decline could be influenced by various macroeconomic factors such as inflation, changes in central bank policies, or market competition.

For investors, these fluctuations in fixed deposit interest rates highlight the importance of monitoring market conditions and financial institution policies. While some banks are adopting aggressive strategies to increase their interest rates and attract more deposits, others are maintaining or slightly reducing their rates, reflecting a more cautious approach.

Investors seeking stable returns might favor banks with consistent interest rates, while those looking for potentially higher returns might consider banks that have recently increased their rates. However, the overall slight decrease in average rates suggests a need for careful consideration of the broader economic context and individual financial goals.

In conclusion, the fixed deposit interest rates in Nepal show a diverse range of strategies among banks, with some prioritizing stability and others making strategic adjustments to their rates. As the financial landscape continues to evolve, staying informed and making data-driven decisions remains crucial for optimizing returns on fixed deposit investments.