By Dipesh Ghimire

Nepal Stock Exchange Announces List of Tradable Companies: A Detailed Analysis

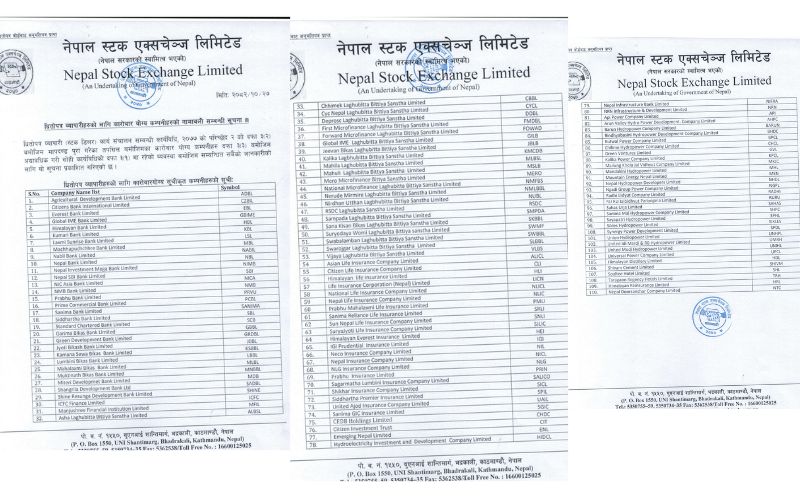

Nepal Stock Exchange (NEPSE) has released an updated list of 110 companies eligible for trading by stock dealers. The list includes companies from various sectors such as banking, microfinance, insurance, hydropower, and hospitality, all of which meet the criteria set out in the Stock Dealer Operational Guidelines, 2077. This list serves as a crucial resource for stock dealers in Nepal, providing them with a comprehensive guide of companies authorized for trading.

Key Sectors and Companies Included in the List:

Commercial Banks (19 Companies):

The financial sector remains dominant, with 19 commercial banks making it to the list. Notable banks include Nabil Bank (NABIL), Himalayan Bank (HBL), and Nepal SBI Bank (NICA).

This sector continues to be the backbone of Nepal's financial system, providing a significant portion of the country's capital and financial services.

Development Banks (10 Companies):

Along with commercial banks, the list also features 10 development banks, which play a pivotal role in financing projects that contribute to economic development. Examples include Garima Bikas Bank (GBBL) and Lumbini Bikas Bank (LBBL).

Microfinance and Finance Companies (22 Microfinance and 2 Finance Companies):

Microfinance institutions, such as Asha Laghubitta (ALBSL) and Chhimek Laghubitta (CBBL), serve the underserved rural and low-income populations by providing small-scale loans.

Finance companies, such as ICFC Finance Limited (ICFC), are also part of this list, which signifies a thriving microfinance sector alongside a larger presence of traditional financial institutions.

Insurance Sector (10 Life and 11 Non-Life Insurance Companies):

The list includes a mix of both life and non-life insurance companies such as Citizen Life Insurance (CU) and Himalayan Life Insurance (HLI), reflecting Nepal's growing insurance sector aimed at increasing the country's financial protection infrastructure.

Hydropower Companies (24 Companies):

With Nepal's significant hydropower potential, the inclusion of 24 hydropower companies such as Butwal Power Company (CHCL), Arun Valley Hydropower (BARUN), and Synergy Power Development Limited (SPDL) in the tradable list indicates a focused effort by NEPSE to promote renewable energy investments.

Hospitality Sector (2 Hotel Companies):

The hospitality sector, though smaller in comparison, is represented by companies like Soaltee Hotel (SHIVM) and Taragaon Regency Hotels (TRH), pointing to the diversification of sectors that Nepalese stock markets are embracing.

Detailed Interpretation of the Data:

Banking Sector's Dominance:

The banking sector's dominance in the list of tradable companies is expected, as it remains the primary driver of Nepal's financial system. The 19 commercial banks, along with the 10 development banks, indicate that Nepal’s financial infrastructure is well-developed and offers a range of services for investors.

The presence of both commercial and development banks highlights the country’s focus on strengthening both large-scale and developmental financial services. This opens up opportunities for both institutional and individual investors.

Rising Influence of Microfinance:

The inclusion of 22 microfinance institutions suggests that Nepal's financial inclusion initiatives are taking root. Microfinance plays a crucial role in reaching underserved populations, which represents a sustainable growth area in Nepal's financial markets.

The microfinance sector is poised to attract international and local investors due to its impact on rural communities and its ability to promote social mobility.

Insurance Sector Growth:

With 10 life and 11 non-life insurance companies, the rise of Nepal's insurance market is evident. The emphasis on this sector is critical for risk management and the long-term financial health of the nation. Nepalese investors are increasingly looking at insurance stocks for their growth potential as the sector matures.

As more citizens turn to insurance for financial protection, the insurance companies on this list are poised to benefit, and their stocks may become attractive for investors seeking long-term stability.

Hydropower Sector's Expanding Role:

The 24 hydropower companies listed underscore the potential of renewable energy in Nepal, a country rich in water resources. The energy sector's growth is central to the nation’s development goals, and these companies represent a huge investment opportunity for stakeholders interested in tapping into Nepal's hydropower wealth.

With increasing investments in this sector, these companies are likely to see a rise in their stock values as they help meet Nepal's domestic power demand and contribute to regional energy exports.

Hospitality and Other Sectors:

The inclusion of a small number of hotel and hospitality companies signifies that NEPSE is aiming to diversify its offerings beyond the financial and energy sectors. With tourism playing a significant role in Nepal's economy, these stocks might attract investors looking to capitalize on the tourism boom.

The list of 110 tradable companies provided by NEPSE marks a step toward the growth and diversification of Nepal’s stock market. The heavy representation of the banking and financial sectors reflects the country's continued reliance on financial services, while the growing presence of microfinance and insurance companies shows a broader market that caters to all segments of society. Hydropower remains a key area of growth, with significant investment potential in this renewable energy sector.

Investors, both domestic and foreign, can look to this updated list for opportunities to diversify their portfolios. The inclusion of sectors like insurance and hydropower also signals a healthy mix of stable and growth-oriented investment opportunities. With such a diverse set of companies, the Nepal Stock Exchange is evolving into a dynamic market that promises substantial returns for investors and significant contributions to the national economy.

This list of tradable companies will further strengthen Nepal’s financial system and provide a foundation for future economic development, signaling positive prospects for investors in the coming years.