By Dipesh Ghimire

NEPSE in Sawan: Will 2082 Repeat Last Year’s Historic Rally? Over 6% Gain in Four Weeks Sparks Investor Optimism

Ajit Khanal

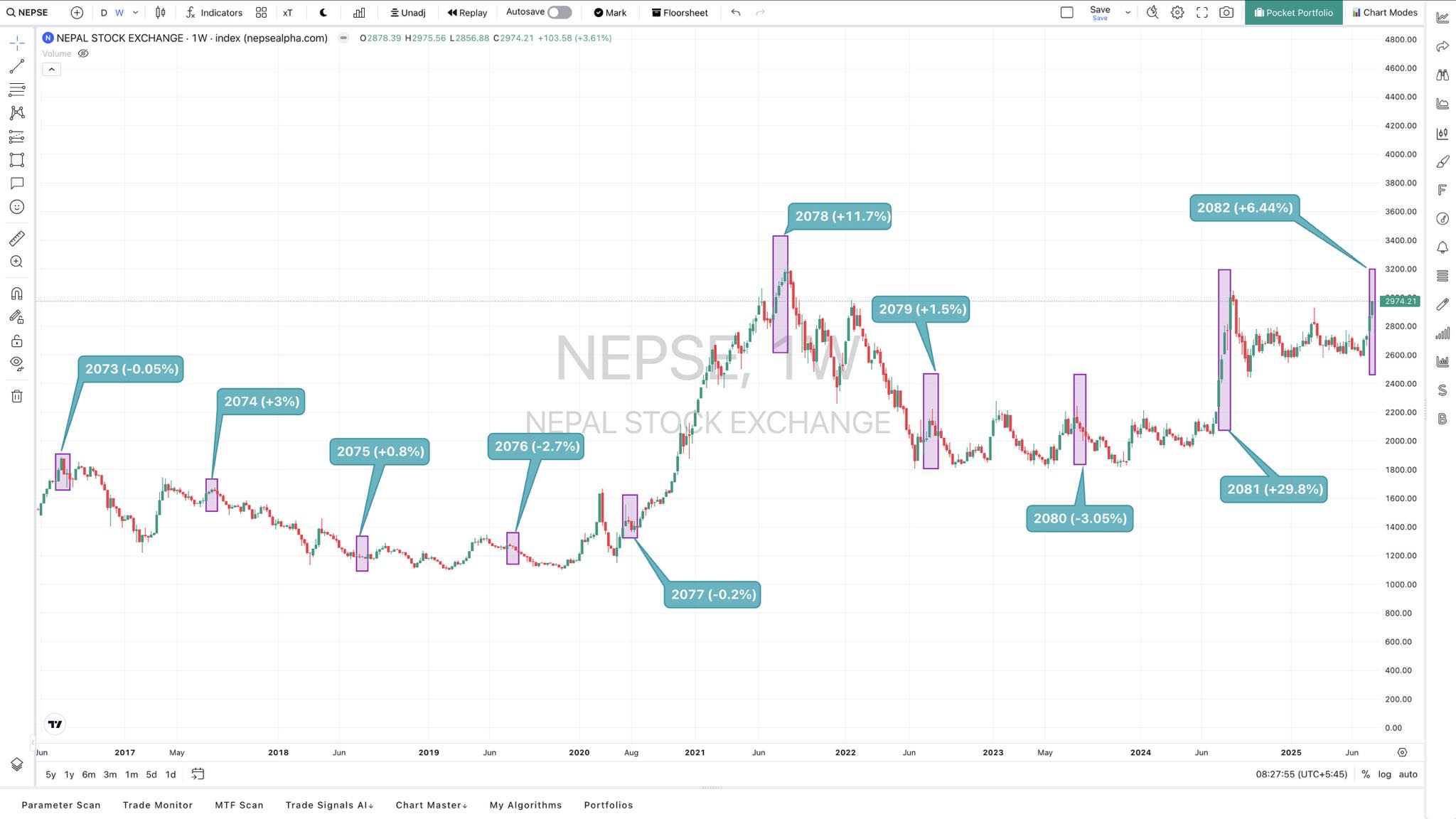

The Nepal Stock Exchange (NEPSE) has kicked off the fiscal year 2082 with strong momentum, showing a notable rise of more than 6% within the first four weeks of the month of Sawan. This upward trend has sparked speculation among investors and analysts alike — could this year’s Sawan mirror the remarkable rally of 2081, when NEPSE surged nearly 30% during the same period?

A review of NEPSE’s past 10-year performance in the month of Sawan shows mixed results, with some years experiencing modest gains and others facing corrections. Notably, in 2081, the index jumped by 29.8%, the highest Sawan-month performance in a decade. In contrast, the previous year (2080) recorded a decline of 3.05%, driven by tightening monetary policies and weaker sentiment.

So far in 2082, NEPSE has shown consistent bullish candles on the weekly chart. Investor confidence has been fueled by active participation from top brokers, sectoral support — especially from hydropower and finance — and a favorable liquidity environment. The index recently broke the 2,929 resistance level and is currently hovering around 2,974 points. The next key resistance lies at 3,045, followed by 3,088 — levels that historically trigger caution among traders.

However, alongside optimism comes a clear technical warning. The Relative Strength Index (RSI) has surged past 84, officially placing the market in the “overbought zone.” This is often interpreted as a signal for possible short-term correction or at least consolidation. Adding to this, a doji candlestick was observed post-breakout — a sign of market indecision and potential slowdown in buying strength.

Technical analyst Ajit Khanal commented, “The breakout above 2,929 was a powerful signal for bulls, but with the RSI at extreme levels and some weakness in volume during the latter trading hours, the market may cool off or move sideways before resuming any further uptrend.”

If the current bullish sentiment sustains, NEPSE could end the month with a double-digit percentage gain — possibly 10% or more. Such a performance would place 2082 among the top three best Sawan-month rallies in NEPSE history. However, if the market fails to break and hold above 3,045, investors may resort to profit-booking, causing short-term dips.

In conclusion, NEPSE’s early Sawan performance is undoubtedly strong, and momentum suggests the rally could continue. But with the index in overbought territory and key resistance levels approaching, investors are advised to remain cautious, apply proper risk management, and wait for clearer technical confirmation before making aggressive moves. The rest of Sawan could be pivotal in defining the trend for the remainder of the year.