By Sandeep Chaudhary

Understanding EPS Variants: EPS-TTM, EPS-Adjusted, EPS-Diluted, and EPS-Annualized

Earnings Per Share (EPS) Variants:

Earnings Per Share (EPS) has several variants that provide different insights into a company's profitability. These include EPS-TTM, EPS-Adjusted, EPS-Diluted, and EPS-Annualized. Each variant serves a specific purpose and caters to different analytical needs.

1. EPS-TTM (Earnings Per Share - Trailing Twelve Months)

EPS-TTM provides an earnings snapshot over the past twelve months. This measure is useful for evaluating a company's recent performance without being influenced by seasonality or single-quarter anomalies.

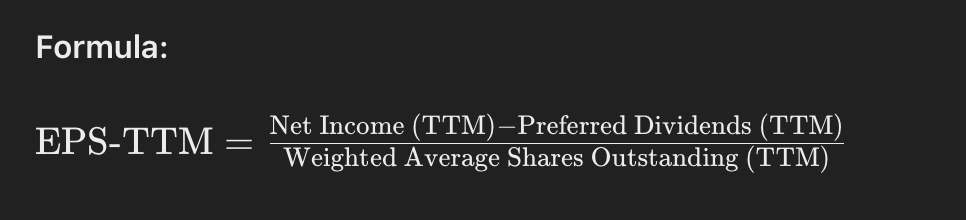

Formula:

Explanation:

Net Income (TTM): Sum of net income for the past four quarters.

Preferred Dividends (TTM): Sum of preferred dividends paid over the past four quarters.

Weighted Average Shares Outstanding (TTM): Average number of shares outstanding over the past twelve months.

2. EPS-Adjusted

EPS-Adjusted excludes one-time gains, losses, and other non-recurring items to provide a clearer picture of a company’s ongoing profitability.

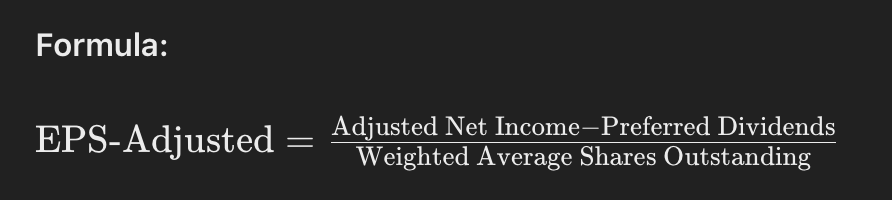

Formula:

Explanation:

Adjusted Net Income: Net income adjusted for non-recurring items, such as asset sales, restructuring costs, or litigation expenses.

Preferred Dividends: Dividends promised to preferred shareholders.

Weighted Average Shares Outstanding: Average number of shares outstanding during the period.

3. EPS-Diluted

EPS-Diluted accounts for all potential shares that could be created through convertible securities, options, and warrants, providing a conservative view of earnings per share.

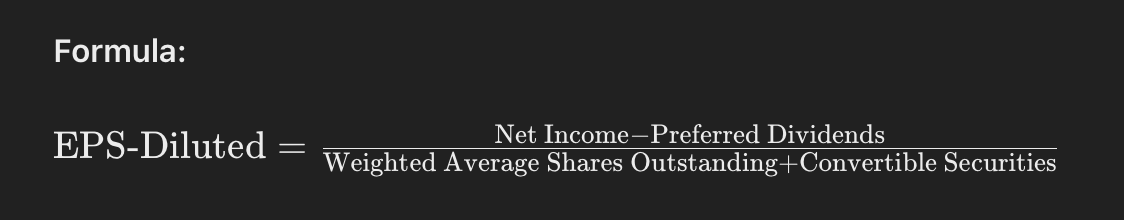

Formula:

Explanation:

Net Income: Total profit after all expenses and taxes.

Preferred Dividends: Dividends promised to preferred shareholders.

Weighted Average Shares Outstanding: Average number of shares outstanding.

Convertible Securities: Potential shares from options, warrants, and convertible bonds.

4. EPS-Annualized

EPS-Annualized projects a company's earnings over a full year based on its most recent performance, useful for companies with seasonal earnings.

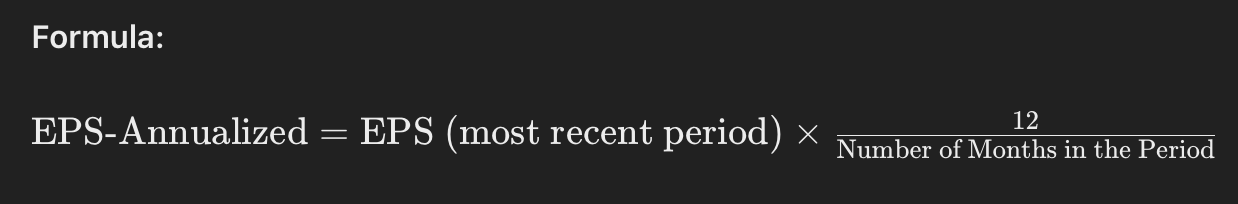

Formula:

Explanation:

EPS (most recent period): EPS calculated for the most recent quarter or half-year.

Number of Months in the Period: The duration of the period used to calculate the recent EPS.

Summary:

Each variant of EPS offers a unique perspective:

EPS-TTM provides a recent historical view.

EPS-Adjusted offers a clearer picture by excluding non-recurring items.

EPS-Diluted presents a conservative measure considering potential share dilution.

EPS-Annualized projects earnings over a full year based on recent performance.

Understanding these variants helps investors make more informed decisions by providing a comprehensive view of a company's profitability.