Bill to Amend the 'Banking Offenses and Punishment Act, 2064' Passed by Finance Committee

Author

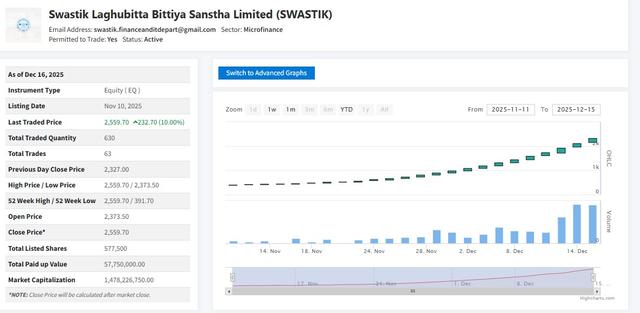

NEPSE trading

The bill titled 'Banking Offenses and Punishment Act, 2064 Amendment Bill, 2080' has been passed with amendments by the Finance Committee. The committee approved the bill with amendments after reaching an agreement on the proposed changes and the issues raised during the clause-wise discussion in its meeting on Monday.

Provisions on Penalties for Dishonored Checks (Check Bounce)

Over NPR 100 million: Imprisonment from two to four years.

Up to NPR 1.5 million: Imprisonment of one month.

NPR 1.5 million to NPR 5 million: Imprisonment from one to three months.

NPR 5 million to NPR 10 million: Imprisonment from three months to one year.

Over NPR 10 million: Imprisonment for up to two years.

Other Provisions

The bill also includes a provision that checks should not be issued without sufficient funds in the bank account. No one should knowingly issue a check or demand payment from the bank if there is no or insufficient balance in their account.

Procedure for Dishonored Checks

Check Return Process: If the required amount is not available in the account, the bank or financial institution must return the check to the holder.

Thirty-Day Notice: If a party wants to prove that a check has been dishonored, the bank must give the account holder a notice with a maximum period of thirty days and keep a record of it.

Verification Process: If the amount is not available within thirty days, the process of certifying the check as dishonored will begin. If the amount is still not available after the deadline, the bank must certify the check as dishonored and return it within three days.

Background of the Bill

The draft of the bill was approved by the Cabinet meeting on Shrawan 23 of the last year.

Then Finance Minister Dr. Prakash Sharan Mahat registered the bill in Parliament on Asoj 16, 2080.

The bill was prepared based on a Supreme Court order and a study by the Office of the Attorney General.

Significance of the Bill

This bill is expected to help maintain transparency and accountability in the banking system, standardize issues related to dishonored checks, and ensure the effectiveness of legal remedies.