Durga Prasai’s NPR 6.80 Billion Loan Scandal: How Much Did He Borrow from Each Bank?

Author

Nepsetrading

Durga Prasai’s Massive Loan Exposure

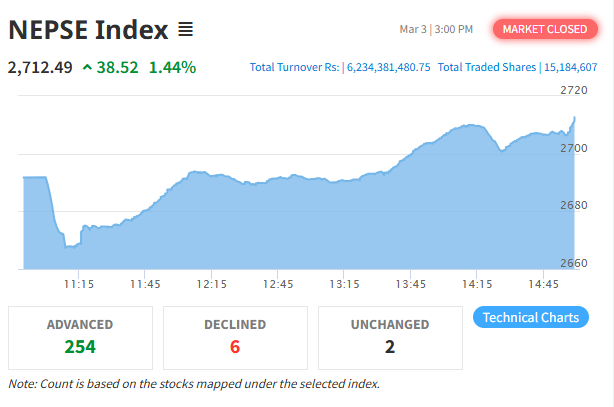

Businessman Durga Prasai has once again come under the spotlight with the revelation of massive outstanding loans taken from multiple financial institutions. According to an infographic published by Bank, Prasai has borrowed a total of NPR 6.80 billion (Rs. 6 Arba 80 Crore) from nine different banks and financial institutions. This level of borrowing is indicative of either a large-scale business operation or a high-risk lending strategy, raising questions about the credit monitoring and approval process of these banks.

Bank-wise Loan Breakdown

The infographic provides a breakdown of the loans Prasai has taken from each institution. The largest amount is from Global IME Bank, which loaned him NPR 1.31 billion. Kumari Bank extended NPR 1.15 billion, Prabhu Bankloaned NPR 1.18 billion, and Nepal Investment Mega Bank (NIMB) loaned NPR 1.02 billion. Other lenders include Nabil Bank (NPR 800 million), Rastriya Banijya Bank (NPR 700 million), Lumbini Bikas Bank (NPR 160 million), and Citizen Investment Trust (NPR 110 million approx.). The fact that such a diverse range of institutions are involved indicates a complex financing network.

Total Exposure and Financial Implications

The total loan exposure of NPR 6.80 billion is not a trivial matter for the Nepali banking sector. If such large loans turn non-performing, they can seriously impact the balance sheets of the lending banks. The ripple effects could include weakened capital reserves, increased NPL (non-performing loan) ratios, and loss of investor confidence. For banks operating in a relatively smaller economy like Nepal, this amount poses significant systemic risk if not managed properly.

Concerns Over Transparency and Regulatory Oversight

This case raises important questions about transparency and due diligence in the loan approval process. Before granting loans, banks are expected to conduct a thorough evaluation of collateral, repayment capacity, and the borrower’s financial history. The fact that multiple banks approved such large loans to a single borrower indicates either extremely favorable financial reporting or inadequate scrutiny. Regulatory bodies such as Nepal Rastra Bank must investigate the lending procedures to ensure compliance with national banking standards.

Public Concern and The Bigger Picture

The public and financial observers are rightfully concerned about how such a large concentration of debt was allowed to accumulate under one individual. In a healthy financial system, no single borrower should pose such a level of risk. If this debt turns problematic, it could lead to widespread consequences across the financial sector. Therefore, it is critical that full transparency is maintained, and regulatory authorities take appropriate action to safeguard the health of Nepal’s banking system.