Nepal Rastra Bank's Monetary Policy for 2081-82: Key Revised Provisions and Impacts

Author

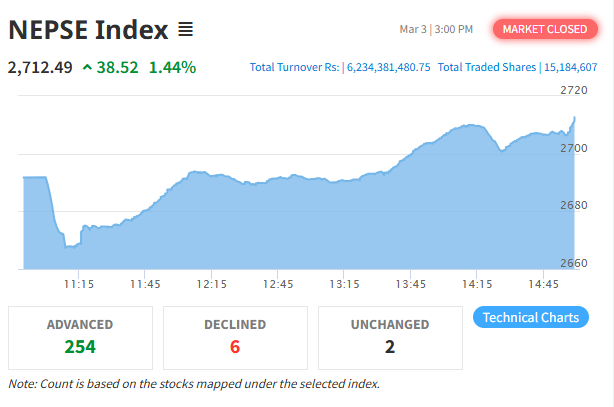

NEPSE trading

Nepal Rastra Bank has recently released its monetary policy for the fiscal year 2081-82, which is expected to have a significant impact on the economy. Governor Maha Prasad Adhikari, in his final monetary policy of his five-year tenure, has included some flexible and expansive provisions aimed at benefiting the banking sector, construction entrepreneurs, small and medium enterprises, and youth involved in foreign employment.

Key Provisions of the Monetary Policy

Loan Expansion Target of 12.5%:

The monetary policy sets a loan expansion target of 12.5%. Governor Adhikari has aimed for banks and financial institutions to expand loans by NPR 654.75 billion. This is expected to increase credit flow in the market, thereby stimulating economic activities.

Collateral-Free Loans for Youth Going for Foreign Employment:

Youth who have received labor approval for foreign employment will now be able to obtain collateral-free loans based on the assurance of remittance to a bank account. This is expected to increase participation in the labor market and boost remittances.

Encouragement of Artificial Intelligence (AI) Use in the Banking Sector:

The policy will encourage the use of AI in the banking sector. This is expected to increase the use of innovative technologies in banks and financial institutions, improving operational profitability and service quality.

Removal of the NPR 200 Million Limit on Share Loans for Institutional Investors, NPR 150 Million Limit for Individuals Remains:

The NPR 200 million limit on share loans for institutional investors has been abolished, while the NPR 150 million limit for individuals remains unchanged. This is expected to reduce psychological fear among share investors and increase demand in the share market.

Extension of Loan Repayment Period for Construction Entrepreneurs, Provision to Avoid Blacklisting:

The repayment period for principal and interest on loans for construction entrepreneurs has been extended until the end of Mangsir 2081. Provisions have been made to prevent blacklisting based on cheque dishonor. This will provide relief to construction entrepreneurs and ease loan management for banks.

Reduction in Good Loan Loss Provision to 1.10%:

The existing loan loss provision has been reduced from 1.20% to 1.10%. This is expected to increase the operating profit of banks and financial institutions by NPR 5 billion.

Extension of Loan Adjustment Period for Working Capital Loans by One Year:

The time to adjust working capital loans has been extended from Shrawan 1, 2082. This will provide immediate ease for businesses in utilizing loans.

Loan Restructuring Facilities for Microfinance Clients:

Microfinance clients who are unable to repay loans due to circumstances will be provided loan restructuring facilities. This will ease the management of non-performing loans for microfinance institutions and increase profitability.

Loans for Education in Medicine, Engineering, IT, and Accounting:

Loans will be available for students pursuing education in medicine, engineering, information technology, and accounting. This will support the development of the education sector.

Preparation of Infrastructure and Institutional Structure for National Payment Switch:

Necessary infrastructure and institutional structure will be prepared to launch the national payment switch. This will modernize, secure, and make the payment system more reliable.

Conversion of Institutions Involved in Payment, Clearing, and Settlement to Public Limited Companies:

Institutions involved in payment, clearing, and settlement will be converted into public limited companies. This is expected to enhance financial inclusion.

Reduction of the Upper Limit of the Interest Rate Corridor to 6.5%, Policy Rate to 5%:

The upper limit of the interest rate corridor has been reduced from 7% to 6.5%, and the policy rate has been reduced from 5.5% to 5%. This will reduce costs for banks and lower interest rates on loans.

Governor Maha Prasad Adhikari's Remarks Governor Adhikari mentioned that the provisions of the monetary policy would help banks and financial institutions manage capital pressure. He stated, "We have implemented various methods and tools to manage the capital pressure on banks. This will bring some ease to the capital pressure faced by banks and financial institutions."

Overall Economic Stability and Financial Inclusion The implementation of the monetary policy is expected to significantly contribute to the country's economic stability, financial inclusion, and modernization of the payment system. Governor Adhikari expressed confidence that the monetary policy would revitalize the economy and improve overall economic activities.

Conclusion The monetary policy is anticipated to play a crucial role in economic stability, financial inclusion, and the modernization of the payment system. The flexible and expansive monetary policy introduced by Governor Maha Prasad Adhikari is expected to revitalize the economy and improve overall economic activities.