By Sandeep Chaudhary

Analysis of Nepal's Interest Rate Trends and Their Implications

Kathmandu, June 7, 2024 - The Nepal Rastra Bank (NRB) has published the latest figures on the structure of interest rates, providing a comprehensive overview from mid-July 2022 to mid-April 2024. The data reveals significant trends and shifts in policy rates, refinance rates, and interest rates across various financial institutions in Nepal.

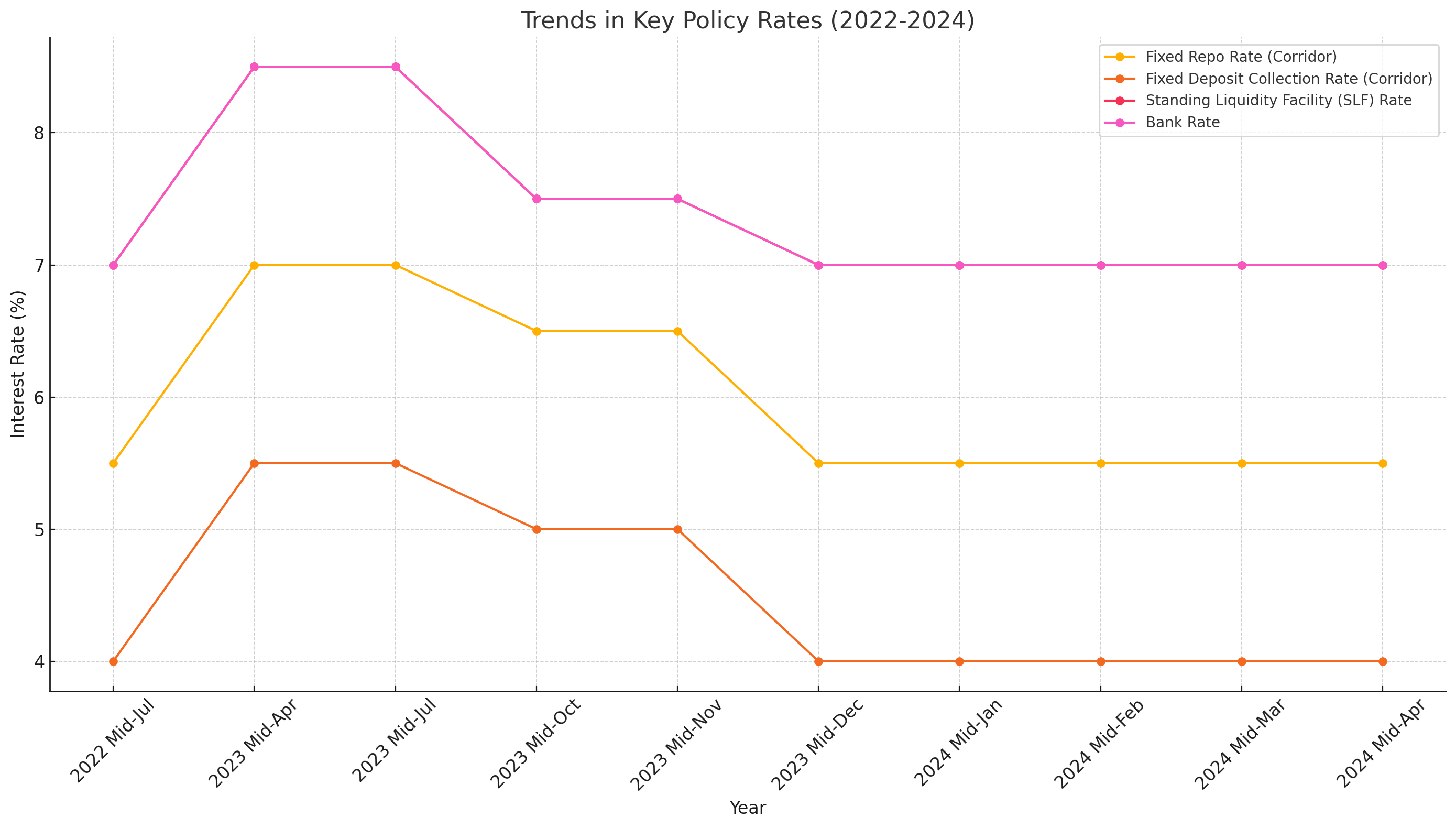

Here's a visual representation of the trends in key policy rates in Nepal from mid-July 2022 to mid-April 2024. The chart showcases the changes in the Fixed Repo Rate, Fixed Deposit Collection Rate, Standing Liquidity Facility (SLF) Rate, and Bank Rate over this period. These trends highlight the Nepal Rastra Bank's monetary policy adjustments and their potential impact on the economic environment.

Policy Rates

One of the notable changes is in the fixed repo rate, which has seen a fluctuation from 5.5% in mid-July 2022, peaking at 7.0% by mid-April 2023, and stabilizing back at 5.5% by mid-April 2024. Similarly, the fixed deposit collection rate has mirrored this trend, moving from 4.0% to 5.5% and back to 4.0% in the same period.

The Standing Liquidity Facility (SLF) rate experienced an increase from 7.0% to 8.5% in mid-April 2023 but returned to 7.0% by mid-April 2024. Meanwhile, the bank rate has consistently decreased from 7.0% to 7.0% within the same timeframe.

Refinance Rates

The refinance rates for special, general, and MSME categories have shown some stability with minor adjustments. Special refinance rates remained steady at 2.0% till mid-October 2023 before increasing slightly to 4.5%. General refinance rates were constant at 5.0% until they dropped to 4.0% from mid-November 2023 onwards. The MSME refinance rate started at 4.0% and reduced to 4.0% by mid-December 2023.

Government Securities

Interest rates on government securities, including Treasury bills (T-bills) and development bonds, exhibit a declining trend. For instance, the interest rate on 28-day T-bills fell from 10.14% in mid-July 2022 to 2.71% by mid-April 2024. This decline indicates a reduction in short-term borrowing costs for the government. Similarly, the rates for development bonds have shown a decrease from around 2.65%-9.20% to 2.65%-10.93% within the same period.

Interest Rates in Financial Institutions

Interest rates for commercial banks, development banks, and finance companies show varied trends. Weighted average interbank rates among BFIs (Banks and Financial Institutions) dropped significantly from 7.01% in mid-July 2022 to 3.74% by mid-April 2024. Similarly, weighted average deposit rates and lending rates among commercial banks decreased, signaling a potential easing of liquidity conditions and an effort to stimulate economic activities.

The weighted average base rate for commercial banks also decreased from 9.54% to 8.58% by mid-April 2024, indicating a lower cost of borrowing.

Interpretation and Implications

The overall downward trend in various interest rates suggests the NRB's effort to ease monetary conditions to support economic growth. Lower rates across the spectrum—from policy rates to refinance rates and government securities—indicate an environment conducive to borrowing, potentially spurring investment and consumption.

However, the volatility and periodic spikes, especially seen in the SLF rate and fixed repo rate, hint at reactive measures taken by the central bank to address short-term liquidity crunches or inflationary pressures.

For businesses and investors, the decrease in borrowing costs can translate to increased investment in infrastructure, expansion, and other capital expenditures. For consumers, reduced lending rates may encourage higher spending and borrowing, boosting overall economic activity.

In conclusion, the trends depicted by the NRB's interest rate structure highlight a strategic approach to balance economic growth while maintaining liquidity and controlling inflation. Stakeholders in the financial sector must keep abreast of these changes to make informed decisions and leverage the prevailing economic conditions.