Banking Sector Profit Falls by 15%, 20 Banks Earn NPR 25.72 Billion in Five Months

Author

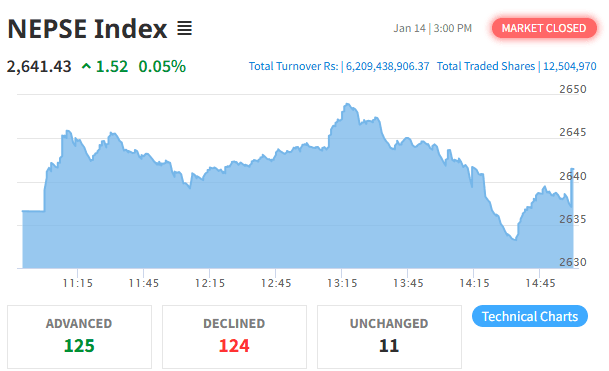

NEPSE TRADING

Kathmandu. The overall profit of Nepal’s commercial banking sector has declined by nearly 15 percent in the first five months of the current fiscal year. According to data published by Nepal Rastra Bank, 20 commercial banks earned a total net profit of NPR 25.72 billion by mid-Mangsir, down 14.95 percent compared to the same period last year, when profits stood at NPR 30.24 billion.

The decline in profitability is mainly attributed to a rise in non-performing loans (NPLs), economic slowdown, weak credit demand, competitive interest rates, and increasing operational costs. Ongoing economic challenges and disruptions have further affected loan recovery and credit growth, putting pressure on bank earnings.

Despite the overall decline, a few banks managed to post profit growth through improved credit and investment management. Global IME Bank emerged as the highest profit-earning bank during the period, recording a 13.69 percent increase with a net profit of NPR 3.22 billion. Rastriya Banijya Bank, Sanima Bank, and Siddhartha Bank also reported improved earnings.

On the other hand, most banks witnessed a drop in profits. Nabil Bank earned NPR 3.11 billion, though this figure declined year-on-year. Prime Commercial Bank, Everest Bank, NMB Bank, Kumari Bank, Laxmi Sunrise Bank, Nepal SBI Bank, and NIC Asia Bank were among those reporting lower profits.

Out of the 20 commercial banks, profits declined in 15 banks, while only six banks recorded growth. The data highlights uneven performance across the banking sector amid rising competitive pressure. Analysts believe that improved credit expansion, cost control, and stronger digital banking initiatives could help banks restore profitability in the coming months.