By Sandeep Chaudhary

Business Life Cycle and Its Impact on Company Valuation

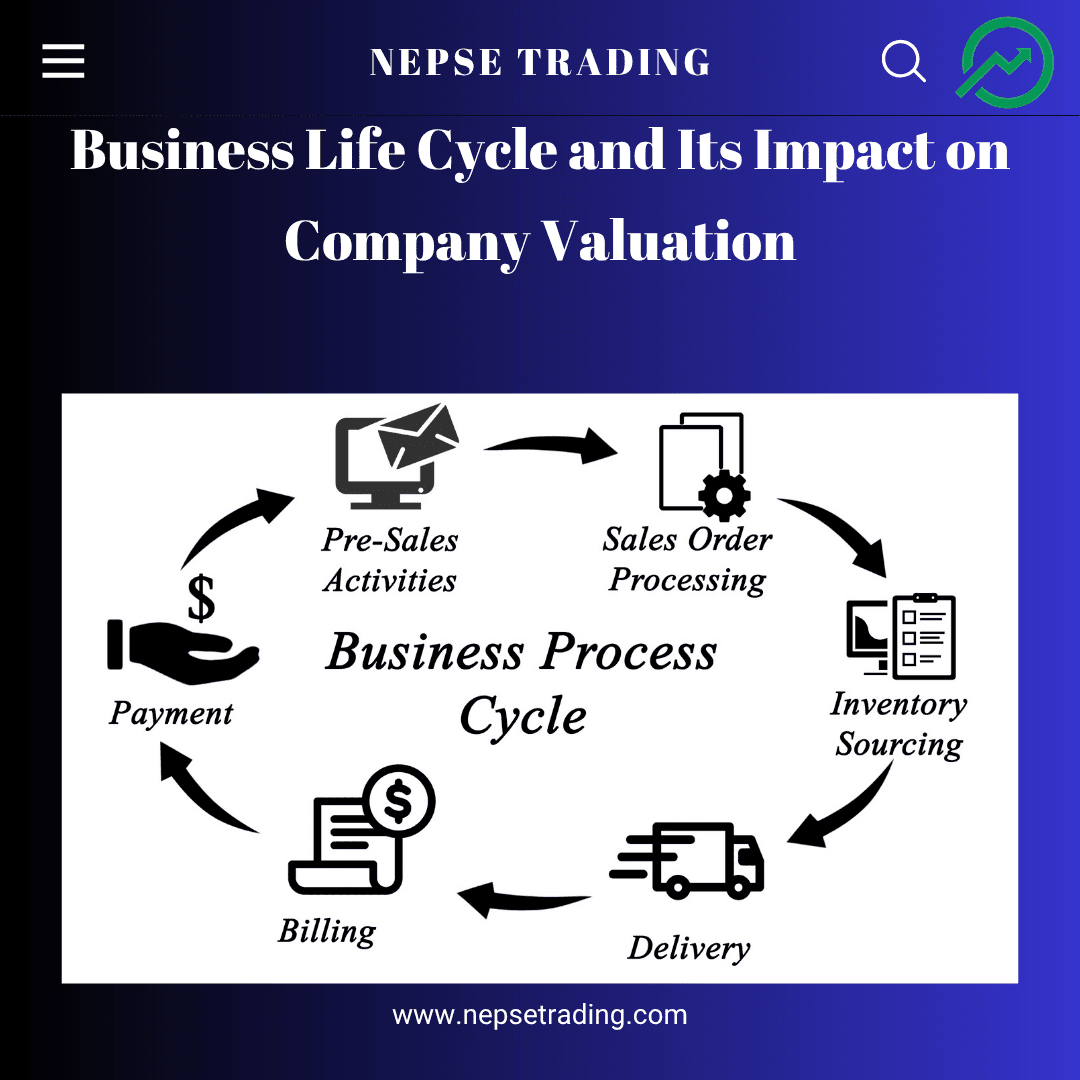

Every company, regardless of its size or industry, follows a natural evolution known as the Business Life Cycle — a process that directly influences its valuation, growth potential, and investor sentiment. For investors in the Nepal Stock Exchange (NEPSE), understanding this life cycle is vital to identifying when a company is undervalued, overvalued, or at the right stage for investment. The life cycle represents how a company begins, grows, matures, and eventually declines if it fails to adapt to changing markets and innovation.

The five main stages of the business life cycle include: Startup, Growth, Maturity, Saturation, and Decline.

In the Startup Stage, companies focus on establishing products and market presence. Risk is high, profits are low, and valuation depends on innovation and potential rather than earnings.

The Growth Stage is marked by rapid expansion, increasing sales, and market acceptance. Companies reinvest profits for further development, and investors value them based on future earnings expectations, resulting in higher valuation multiples like P/E and P/B ratios.

During the Maturity Stage, the company achieves stability, consistent revenue, and strong brand positioning. Growth slows down, but cash flow and dividends increase. Investors often seek such companies for long-term income and stability.

The Saturation Stage reflects a point where competition intensifies, and growth stagnates. Companies must innovate or diversify to maintain valuation.

Finally, in the Decline Stage, revenues fall, costs rise, and market relevance fades. Valuation declines as investor confidence weakens unless turnaround strategies are visible.

In Nepal, hydropower, banking, insurance, and manufacturing companies reflect various phases of this cycle. For example, new hydropower IPOs are typically in the growth phase, while old commercial banks like NABIL or SCB Nepal represent maturity with stable dividends but limited growth. Meanwhile, older manufacturing firms facing technological challenges may be entering decline. Recognizing these stages helps investors align portfolios according to goals — choosing growth stocks for capital appreciation and mature companies for stable returns.

From a valuation perspective, business life cycle stages determine how analysts use tools like Discounted Cash Flow (DCF), P/E ratios, and Dividend Discount Models (DDM). Growth companies are valued on future potential, while mature ones rely on present cash flow strength.

According to Sandeep Kumar Chaudhary, Nepal’s top Technical and Fundamental Analyst and founder of the NepseTrading Training Institute, “Understanding the business life cycle is the foundation of valuation. You don’t invest only in a company — you invest in its phase of growth.” With over 15 years of banking experience and having taught 10,000+ Nepali investors, he emphasizes that recognizing a company’s life stage allows investors to apply the right valuation method and risk management strategy for consistent success in NEPSE.