By Sandeep Chaudhary

Smart Money Concept (SMC) in Nepal – Institutional Order Flow

In modern Technical Analysis, the Smart Money Concept (SMC) has become one of the most advanced and realistic approaches to understanding how large institutions — such as banks, funds, and market makers — control market direction through liquidity manipulation and order flow. In the Nepal Stock Exchange (NEPSE), where price action often appears unpredictable to retail traders, understanding the logic behind institutional order flow gives a major edge in identifying true market intentions. SMC reveals that markets do not move randomly — they move strategically to collect liquidity and trap retail traders before the real move begins.

The core idea of the Smart Money Concept is that “smart money” — institutional investors — accumulate and distribute positions using hidden footprints in price structure. These footprints appear in the form of Order Blocks, Liquidity Zones, Inducements, Break of Structure (BOS), and Fair Value Gaps (FVG). Instead of relying on indicators, SMC traders read raw price movements and volume imbalances to track how institutional money operates within the chart.

Order Blocks (OB): These are institutional footprints — zones where large orders were placed before big market moves. When price returns to these blocks, it often reacts strongly.

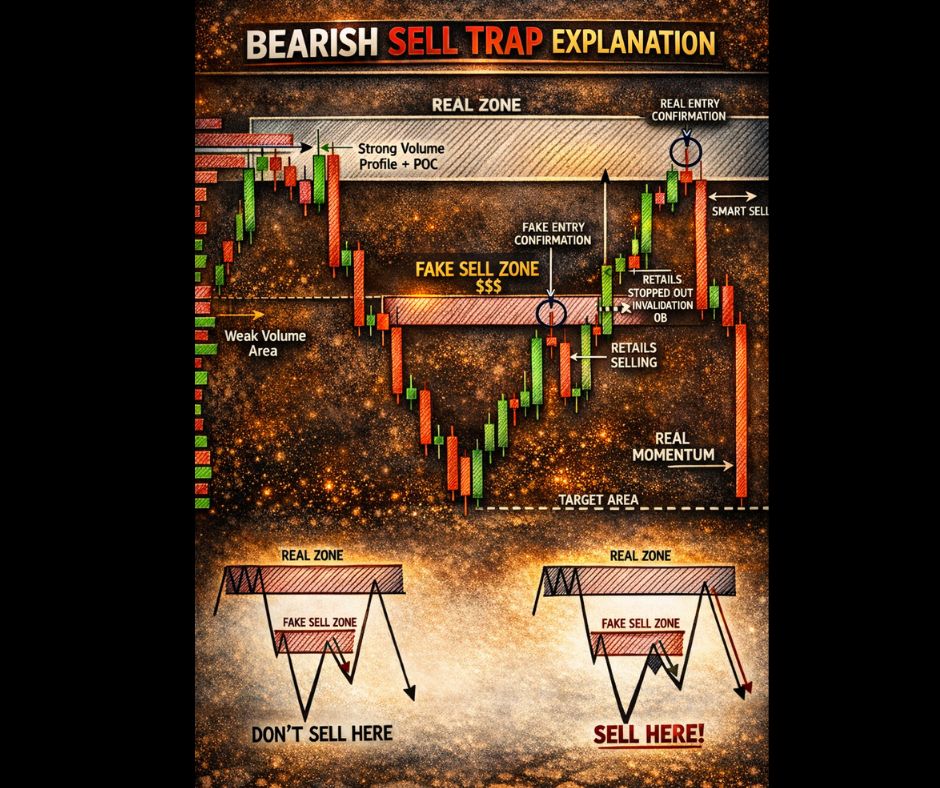

Liquidity Zones: Institutions target areas where retail traders’ stop-loss orders are clustered. Liquidity grabs are often followed by sharp reversals.

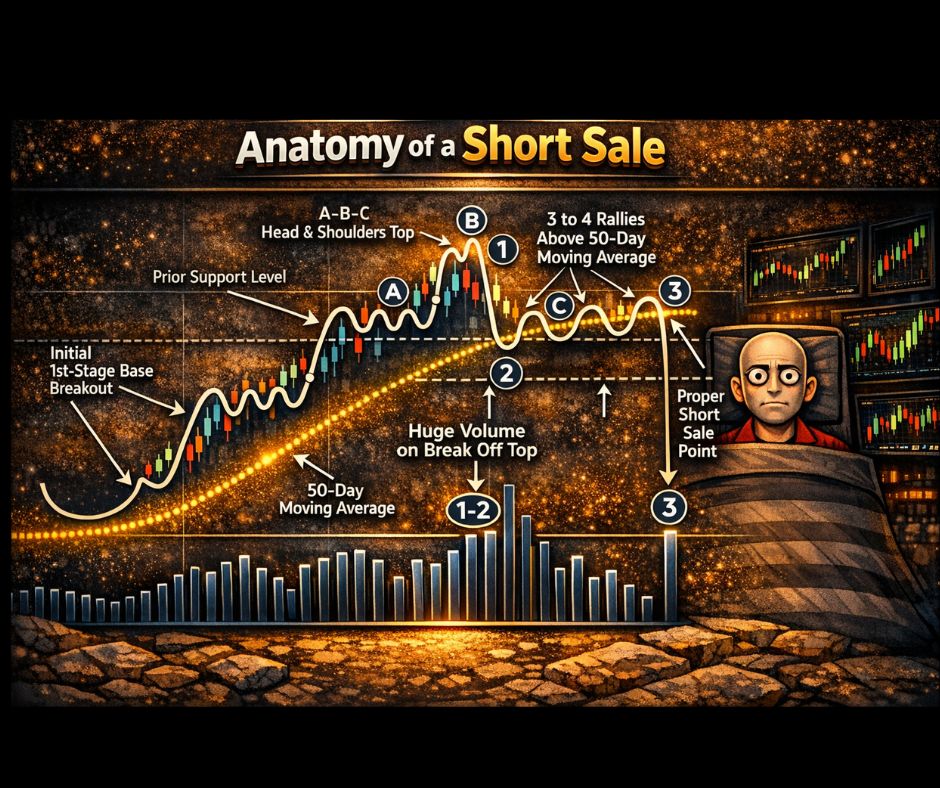

Break of Structure (BOS): A clear shift in market direction that confirms institutional intent.

Fair Value Gaps (FVG): Imbalances left behind by aggressive institutional moves, which price later revisits to “fill” inefficiencies.

Inducement: A manipulation tactic where price lures traders into false setups before reversing.

In the context of NEPSE, these principles apply perfectly — large investors and institutional brokers accumulate shares quietly in banking, hydropower, and manufacturing sectors before initiating strong trends. When retail traders buy at resistance or sell into support, smart money collects their liquidity, causing the familiar “false breakout” phenomenon seen in NEPSE charts.

According to Sandeep Kumar Chaudhary, Nepal’s top Technical Analyst and founder of NepseTrading Elite, “SMC teaches traders to think like institutions, not like the crowd. Once you learn to read order flow, you stop chasing price and start anticipating moves.” With over 15 years of banking and market experience, and professional training from Singapore and India, he mentors traders on combining Smart Money Concepts, Elliott Waves, ICT methodology, and Fibonacci geometry to decode the invisible hand behind market movements.