By Dipesh Ghimire

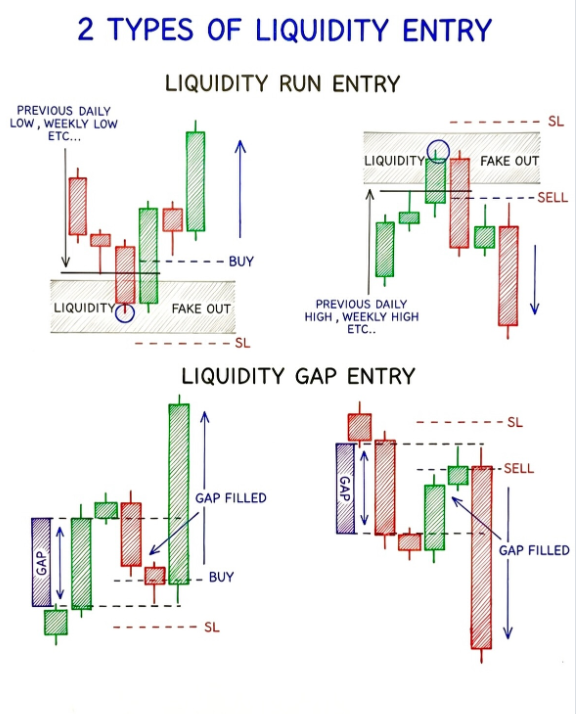

Understanding the Two Types of Liquidity Entry in Trading

In trading, liquidity entry strategies are crucial for capitalizing on market movements. The two most common methods are Liquidity Run Entry and Liquidity Gap Entry, both of which utilize market liquidity and price gaps to determine the best times for entering trades.

1. Liquidity Run Entry

The Liquidity Run Entry strategy focuses on buying or selling when the market runs towards an area with significant liquidity, such as the previous day's low or high, weekly lows, or highs. These are critical price levels where large orders are typically waiting, influencing the price to either reverse or continue its trend.

Buy (Liquidity): This occurs when the market price runs towards a previous low (such as the daily or weekly low). Traders enter a buy position when the market hits the liquidity zone, expecting the price to rise after hitting support at that level.

Fake Out: Sometimes the market may initially break the liquidity level but then quickly reverse direction. This is known as a fake out—a false breakout where the price initially moves past a support or resistance level but then returns to the opposite direction.

Sell (Liquidity): In a Liquidity Run Entry for a sell, the market will run towards a previously identified high (like the daily or weekly high). Once the price reaches this liquidity area, traders expect the price to reverse and enter a sell position.

The key idea here is to enter positions when liquidity zones are targeted, using price reversals after fake outs or breakouts.

2. Liquidity Gap Entry

The Liquidity Gap Entry strategy focuses on price gaps, which occur when the price of a security opens higher or lower than its previous close. These gaps often attract traders as they can indicate potential areas for price continuation or reversal.

Gap Filled (Buy): A gap in the market might be filled when the price moves to close the gap. In this scenario, traders may buy after the gap is filled, anticipating that the market will continue to rise following the gap closure.

Sell (Gap): Conversely, when a price gap occurs in a downward direction and gets filled, traders may enter a sell position, expecting that the price will continue to drop after the gap is filled.

SL (Stop Loss): In both types of entries, a stop loss (SL) is placed to manage risk. This is a critical tool to ensure that losses are minimized if the market does not move in the anticipated direction.

Interpretation of the Chart

The chart divides the strategies into two distinct sections, Liquidity Run Entry and Liquidity Gap Entry, showing how both strategies capitalize on liquidity zones and price gaps to enter trades effectively. In both strategies, liquidity is a central focus—whether it’s through previously established price levels (daily/weekly highs or lows) or the market's reaction to gaps.