By Dipesh Ghimire

SEBON’s New Draft Margin Trading Directive Set to Reshape Nepal’s Capital Market: Stricter Rules, Higher Discipline, and Stronger Risk Controls Introduced

The Securities Board of Nepal (SEBON) has released the Draft Margin Trading Directive, 2082, marking a significant regulatory overhaul aimed at strengthening transparency, reducing systemic risk, and professionalizing margin trading practices in Nepal’s stock market. The draft, issued under the authority of Section 87(1) of the Securities Act, 2063, has been opened for public feedback for seven days. Once implemented, it will officially replace the existing Margin Trading Directive of 2074, which could not achieve full operational effectiveness.

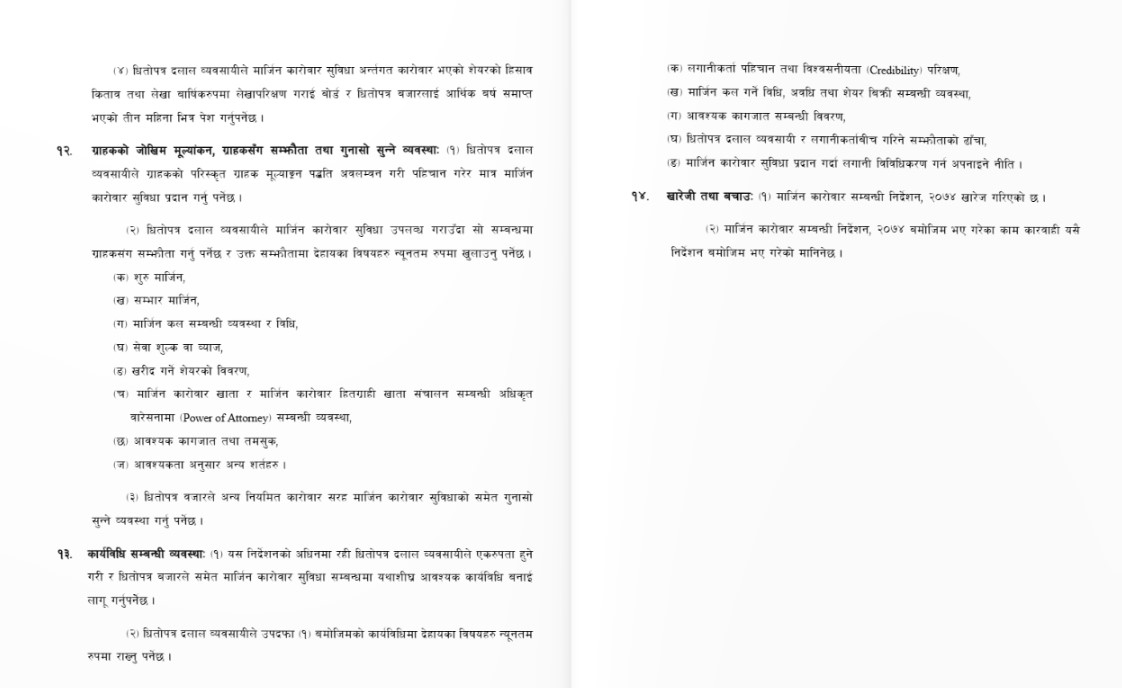

The draft directive introduces much stricter eligibility criteria for stocks that can be used for margin trading. Only companies with at least five million publicly listed shares, net worth greater than or equal to paid-up capital, consistent dividends in two of the last three years, and a minimum two-year listing history after the IPO will qualify. These conditions are designed to prevent investors from taking leveraged positions in unstable or newly listed companies, thereby reducing market volatility and protecting retail participants from excessive risk.

SEBON has also raised the bar for brokers wishing to provide margin trading services. Only brokerage firms with a minimum paid-up capital of Rs 200 million will be eligible to operate in the margin segment. Brokers must additionally hold clearing membership, depository membership, and comply with all operational rules set by the stock exchange. These measures indicate SEBON’s intent to ensure that only financially strong and well-managed brokers are allowed to extend credit, reducing the risk of broker-level financial failure during market fluctuations.

The directive places clear limits on how much margin exposure brokers may take. Brokerage firms may extend margin loans up to five times their certified net worth, but they cannot provide more than 20 percent of their net worth to a single client or that client’s household members. In addition, brokers must maintain adequate diversification across their margin portfolios. This provision minimizes concentration risk and prevents large clients from dominating the lending capacity of brokers, ensuring a safer and more balanced market environment.

In terms of funding sources, brokers will be permitted to use their own capital, loans from banks and financial institutions, and unsecured loans from shareholders or directors for margin lending. However, SEBON has placed a strict cap: the total amount borrowed from commercial banks and unsecured loans from insiders cannot exceed 4.5 times the broker’s net worth. This mechanism prevents brokers from aggressively borrowing to fuel high-risk margin lending, reducing the chances of liquidity crises or systemic instability.

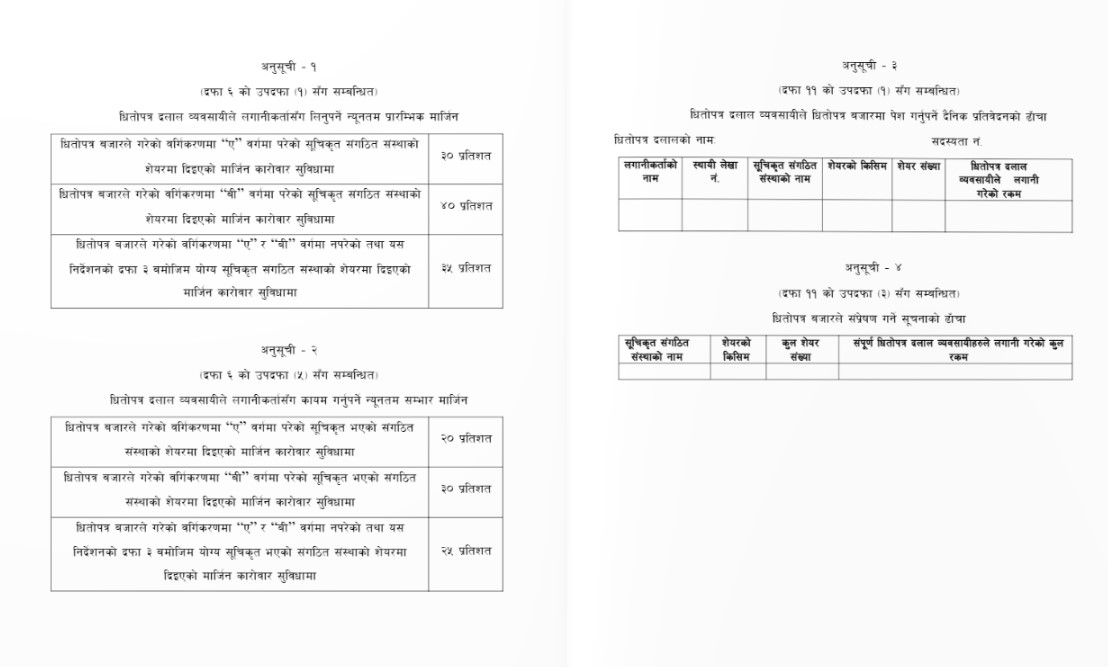

The draft directive also strengthens investor protection by prohibiting brokers from using one client’s cash or securities as collateral to provide margin loans to another client. Each investor must have a separate margin trading account and a separate margin beneficiary account, ensuring complete segregation of client assets. Brokers are further required to maintain daily mark-to-market (MTM) valuation of margin-purchased shares. Although shares may appreciate in value, brokers are not allowed to extend additional margin facilities solely based on rising prices, preventing the development of inflated leverage cycles.

To reinforce risk control, brokers are empowered to demand additional margin when market conditions deteriorate or when the underlying securities become riskier. Investors must maintain the minimum maintenance margin throughout the duration of the loan. If an investor fails to meet margin calls or repay borrowed amounts, brokers may liquidate the pledged shares under the authority of the signed authorization letter. SEBON requires brokers to notify the exchange about such forced liquidations, enhancing transparency and oversight.

The draft further outlines detailed procedures for clearing and settlement. Investors must open a dedicated margin trading account and a corresponding margin beneficiary account. Brokers, as clearing members, must open a separate margin settlement beneficiary account with CDSC. All accounts must be systematically linked to ensure proper settlement, accurate reporting, and a verifiable audit trail. These operational requirements align Nepal’s margin market with international standards of compliance and market discipline.

The issuance of this directive comes after the earlier 2074 directive failed to achieve full implementation. SEBON’s new approach reflects lessons learned over the past years — including risks associated with unregulated leverage, volatile trading behavior, and insufficient oversight of brokers. Market analysts believe the new directive will significantly enhance stability, reduce speculative excess, and create a healthier margin trading environment.

In conclusion, SEBON’s Draft Margin Trading Directive, 2082 represents a transformative step toward building a safer, more transparent, and more resilient capital market in Nepal. By enforcing stronger requirements for both brokers and investors, and through stricter risk controls, SEBON aims to prevent market-wide vulnerabilities and support long-term sustainable growth. While the rules may initially appear restrictive to some market participants, they ultimately promote greater accountability and align Nepal’s financial market with global regulatory practices.