By Sandeep Chaudhary

Stock Market Sees Fluctuations in Turnover and Trading Volume

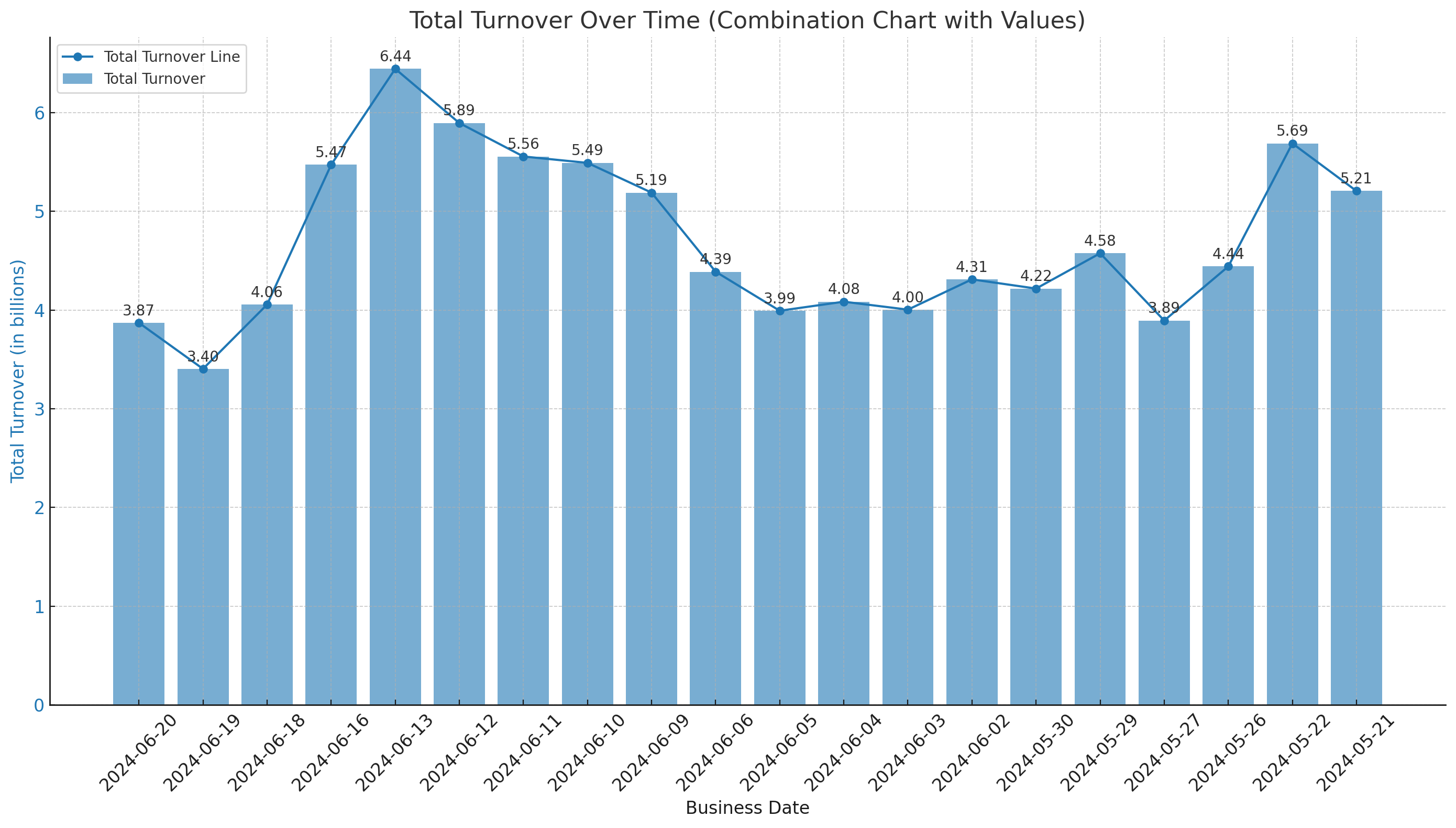

The Nepal Stock Exchange (NEPSE) witnessed significant fluctuations in turnover and trading volume over the past few weeks, reflecting a dynamic trading environment. Here's an in-depth analysis of the recent stock market trends and their implications for investors.

Market Performance Overview

From May 21, 2024, to June 20, 2024, the total turnover experienced notable highs and lows. The highest turnover recorded was NPR 6.44 billion on June 13, 2024, with a corresponding trading volume of approximately 14.29 million shares. This peak highlights a day of robust trading activity, likely driven by positive market sentiment or significant corporate announcements.

Conversely, the lowest turnover within this period was on June 19, 2024, at NPR 3.40 billion, with a trading volume of around 7.21 million shares. The decrease in turnover suggests a day of cautious trading, possibly influenced by external economic factors or investor uncertainty.

Key Trends and Insights

Volatility in Turnover and Trading Volume: The data indicates considerable volatility in both turnover and trading volume. For instance, the turnover jumped from NPR 3.87 billion on June 20 to NPR 4.05 billion on June 18. Such fluctuations can be attributed to varying investor sentiment, external economic conditions, and specific events impacting the market.

High Trading Volume Correlates with Increased Turnover: Days with high trading volumes, such as June 13, also saw high turnover. This correlation suggests that increased investor activity, possibly driven by favorable market conditions or announcements, boosts overall market liquidity.

Impact of External Factors: The turnover dip on June 19 could be linked to broader economic concerns or global market trends. Investors often react to news and economic indicators, leading to reduced trading activity during uncertain times.

Consistent Scrips Traded: The number of scrips traded remained relatively stable, averaging around 315. This consistency indicates a broad interest in various stocks, maintaining a diversified trading environment.

Interpretation and Implications for Investors

The NEPSE's recent performance underscores the importance of staying informed and agile in response to market conditions. Investors should consider the following strategies:

Diversification: Given the volatility, maintaining a diversified portfolio can help mitigate risks associated with market fluctuations.

Stay Informed: Keeping abreast of economic indicators and corporate announcements can provide insights into potential market movements.

Long-Term Perspective: While short-term volatility is evident, focusing on long-term investment goals can help navigate through the ups and downs of the market.

Conclusion

The NEPSE has shown a dynamic trading environment over the past month, characterized by significant turnover and trading volume fluctuations. Investors must remain vigilant and adapt their strategies to capitalize on opportunities while managing risks. The market's performance serves as a reminder of the importance of informed decision-making in achieving investment success.

This analysis provides a comprehensive overview of the recent stock market trends in the NEPSE, offering valuable insights for investors to navigate the evolving market landscape.